USA: President Trump Announces “Reciprocal” Tariffs

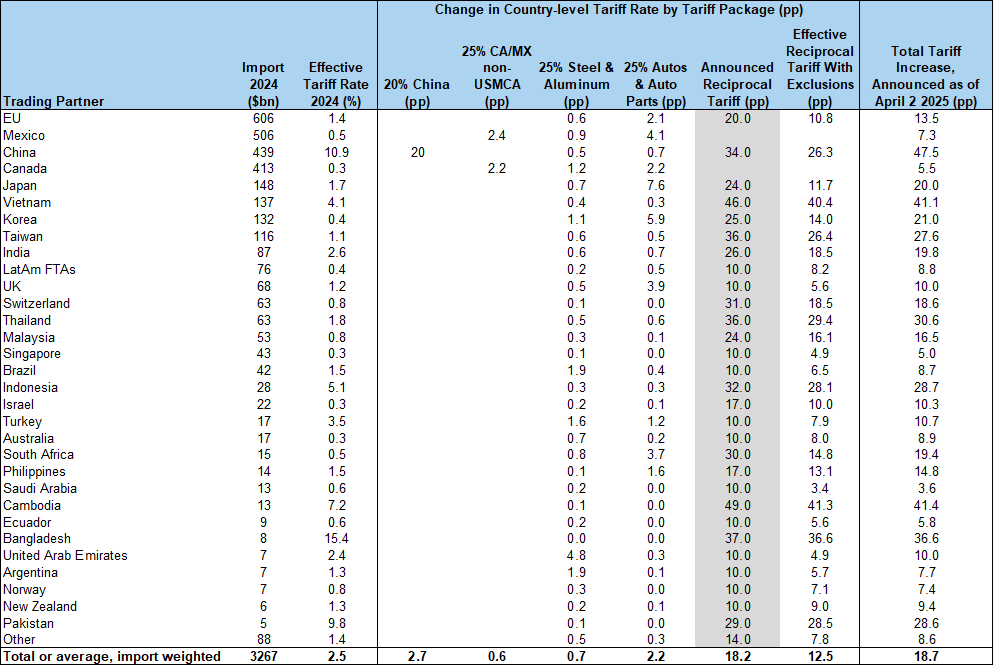

BOTTOM LINE: The “reciprocal” tariff policy President Trump announced would impose a weighted average tariff rate of 18.2%, around 3pp higher than we expected. However, roughly 1/3 of total imports would be exempt, which reduces the impact to a 12.5pp increase in the effective tariff rate. We estimate this and other tariffs announced year-to-date would raise the US effective tariff rate by 18.7pp. While we assume that negotiations with trading partners will lead to somewhat lower “reciprocal” rates than announced today, the prospect for escalation following retaliatory tariffs and a high probability of further sectoral tariffs suggests a risk that the US effective tariff rate rises more than the 15pp increase we assume in our economic forecast.

1. President Trump announced a "reciprocal" tariff plan that consists of two parts. First, a 10% baseline tariff would apply to imports from all countries excluding Canada and Mexico. This tariff is set to take effect April 5. Second, most major trading partners excluding Canada and Mexico would face an additional tariff that equals half the ratio of the US bilateral trade deficit with the country divided by US imports from that country. This second component would take effect April 9. The fact that these two components were structured separately suggests that the 10% baseline tariff is unlikely to be negotiated down, but that the additional tariff rate could decline following negotiation with trading partners.

2. The tariffs average to 18.2% when weighted by imports, but the increase in the effective tariff rate would likely be around 12.5pp due to product exclusions. The executive order states that these tariffs exclude products that are subject to sectoral tariffs, including sectoral tariffs not yet announced. Specifically, tariffs will not apply to steel, aluminum, and autos where tariffs have been implemented, copper or lumber, which face pending Sec. 232 investigations, nor pharmaceuticals, semiconductors, or critical minerals, where Sec. 232 investigations are expected but have not yet been announced. The exemption also applies to energy products. While we had expected auto imports to be exempt from the reciprocal tariff, this exemption is somewhat wider than expected and covers $1.1 trillion (roughly 1/3) of imports. However, this broader exemption exists mainly because additional sectoral tariffs look likely, which will add to the overall effective tariff rate when they take effect, likely later this year.

3. Canada and Mexico received better treatment than we expected. The executive order continues to exempt USMCA-compliant imports from the 25% tariff on Canada and Mexico. We had expected at least an incremental tariff increase on both countries. The order states that if the exemption ends in the future, USMCA-compliant goods and energy products would receive duty-free treatment while non-compliant products would face a tariff rate of 12%, excluding energy and potash which would be duty-free. This 12% rate might signal the upper bound for tariff rates for Canada and Mexico.

4. Most Asian trading partners face a higher tariff than we expected. We had expected China imports to be covered by the reciprocal tariff announcement and believed that this would add to the 20pp in China-focused tariffs already imposed in February and March. However, the 34% tariff rate announced is higher than expected. The higher tariff rate includes imports from Hong Kong and Macau. Other Asian exporters also face much higher tariff rates, including Vietnam (46%), Taiwan (36%), Thailand (36%), and Indonesia (32%), among others. This appears due to the simplified methodology the US Trade Representative’s office used, described above.

5. The order specifies that the new reciprocal tariff rates apply only to the non-US content of goods, if at least 20% of the content is US-origin. This could incrementally reduce the effect of the tariff rate, but the exclusion of US content would have been most important for Canadian and Mexican imports and is unlikely to be an important factor for imports generally.

6. De minimis treatment will remain in place except for China. The order temporarily preserves tariff-free treatment for personal shipments under $800 for countries subject to the reciprocal tariff until the Sec. of Commerce can certify that systems are in place to apply tariffs to these smaller shipments. A separate executive order President Trump signed today rescinds de minimis treatment for shipments from China in particular, which currently account for a substantial share of total de minimis volume.

Alec Phillips

Elsie Peng

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.