US tariffs should significantly affect global trade flows and economic activity. In this Global Economics Comment we examine how global data releases can provide early signals on the trade impacts of tariffs.

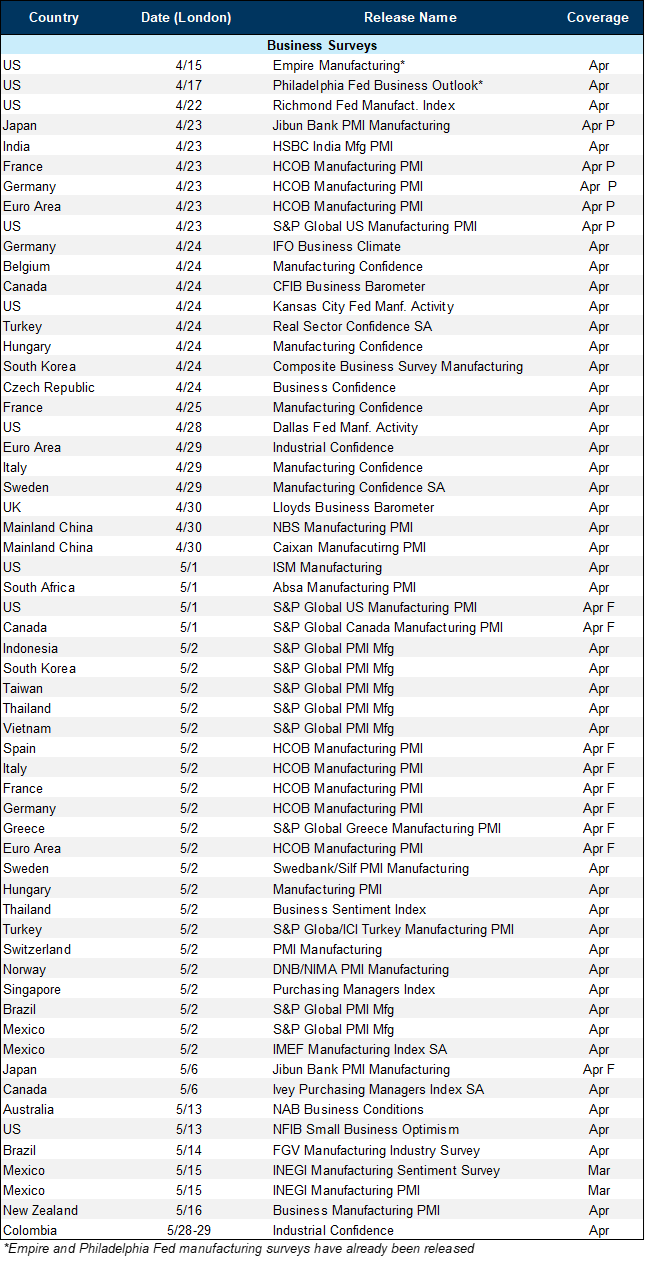

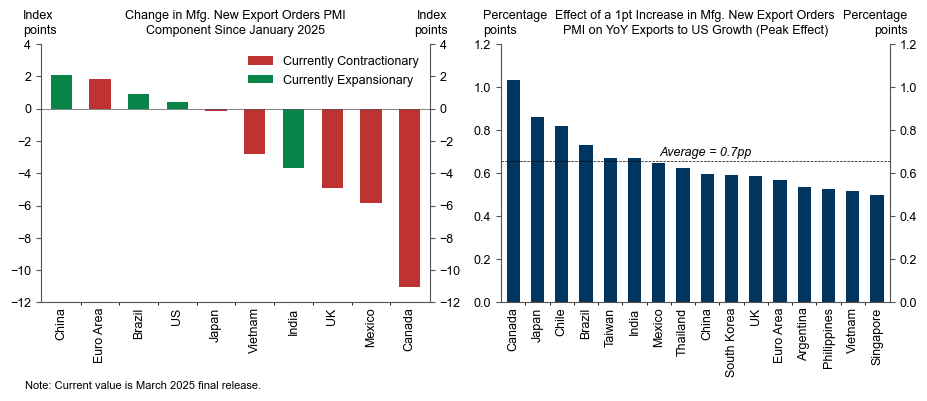

The first manufacturing business surveys covering the post-April 2 period are scheduled for release this week. We will be paying close attention to the new export orders components in the April surveys, especially since the March data showed a sharp pullback for countries that were affected by tariffs earlier (i.e., Canada and Mexico), and historically each 1pt pullback in new export orders has predicted a ¾pp hit to year-over-year export growth.

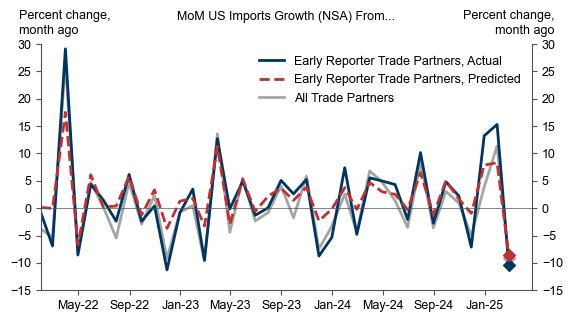

Actual exports from several economies have picked up recently due to frontloading but should pull back with tariff implementation. We will be most closely following trade releases for the over 50% of US trade partners (trade-weighted basis) that report April exports ahead of the US advance goods trade balance on May 30—including South Korea (5/1), Vietnam (5/6), Brazil (5/7), China (5/9), India (5/16), Japan (5/21) and Mexico (5/23)—since historically these early releases have been highly predictive of US trade flows.

Given that global economic releases follow a similar release pattern within each month, we will monitor these data beyond April to evaluate the tariff impacts on trade. We will also monitor port traffic data—which so far show a pullback in Chinese shipments but little impact elsewhere—for an alternative real-time, albeit noisier signal of shifting trade patterns.

Tracking Trade Impacts of Tariffs in Global Economic Data

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.