Global Views: On the Precipice

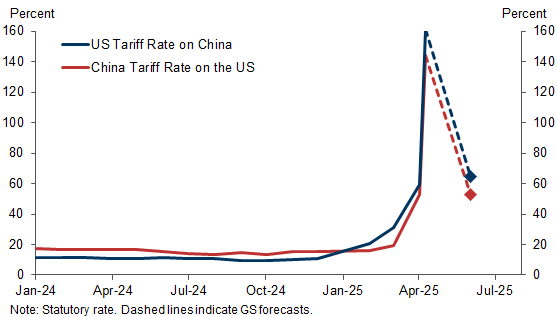

1. The Trump administration has continued to soften some of its most aggressive tariff policies. Following the 90-day pause of the supplementary “reciprocal” tariffs and the exemption of ICT products from the China tariffs, the White House recently modified the auto parts tariff to prevent stacking with steel/aluminum and to partially reimburse automakers for their increased costs. Preliminary trade agreements with a few countries could follow soon. The mood music with China has improved, and we expect the US tariff rate on China to drop from around 160% to around 60% relatively soon. (China is likely to reduce tariffs on the US by a similar amount.)

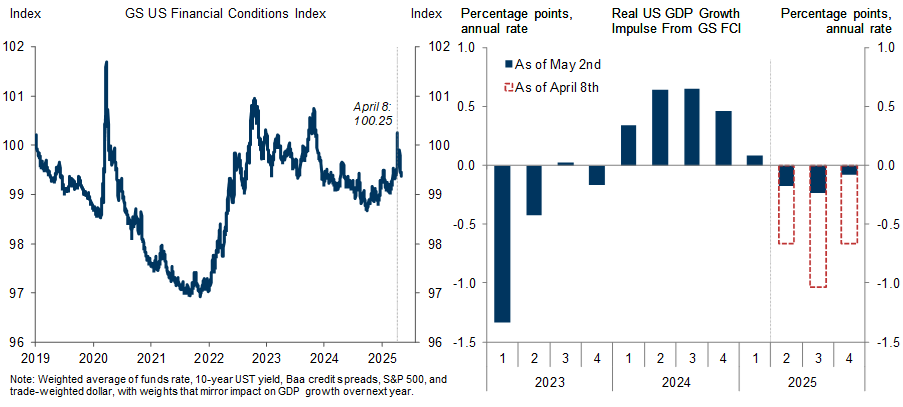

2. The resilience in the hard economic data has also reassured investors. While the information in Friday’s better-than-expected employment report was collected from April 6 to April 12 and is therefore quite dated, the timelier jobless claims data indicate continued resilience—at least on the layoff side of the labor market— when adjusted for last week’s upward distortion from the timing of NY school holidays. (We put little weight on Q1 GDP, which is not only very dated but also very distorted by pre-buying.) All this has helped financial conditions ease sharply. Based on the current FCI level, we estimate a peak financial conditions drag on US GDP growth of 0.2pp in Q3, down from 1.0pp on April 8.

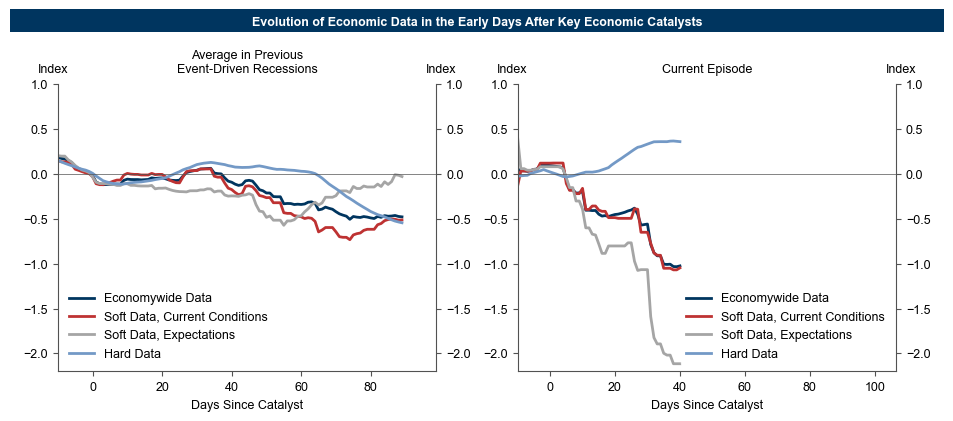

3. Nevertheless, our 12-month recession risk estimate remains 45%. Beyond US-China, we still expect further tariff increases in other areas—e.g. pharmaceuticals, semiconductors, and potentially movies—and see a meaningful risk that some of the paused “reciprocal” tariffs will take effect after all. Moreover, it is not unusual for hard data to lag significantly in event-driven downturns, and the surge in pre-buying probably lengthens that lag further. It is notable that the soft data—which have their own shortcomings but are less susceptible to pre-buying distortions—have already fallen more than in the typical event-driven recession, even when we take the slightly better-than-expected ISMs for April into account. This is especially true for consumer and business expectations, and to a lesser degree for current conditions as well.

4. The outlook for Fed policy remains very uncertain, but we have pushed back the first of the three consecutive 25bp insurance cuts in our baseline forecast from June to July. Criticism from President Trump will not trigger a Fed policy response—neither an early cut without evidence of labor market deterioration nor a stubborn refusal to cut once the labor market does soften, provided long-term inflation expectations remain anchored. But we worry about more fundamental threats to the Fed’s monetary policy independence. If the White House gains the ability to remove the chair and other FOMC members without “cause”—defined as inefficiency, neglect of duty, or malfeasance in office—this would make the Fed a negative outlier among DM central banks in terms of removal protections. Academic studies and our own analysis show that reduced independence predicts worse inflation outcomes over time.

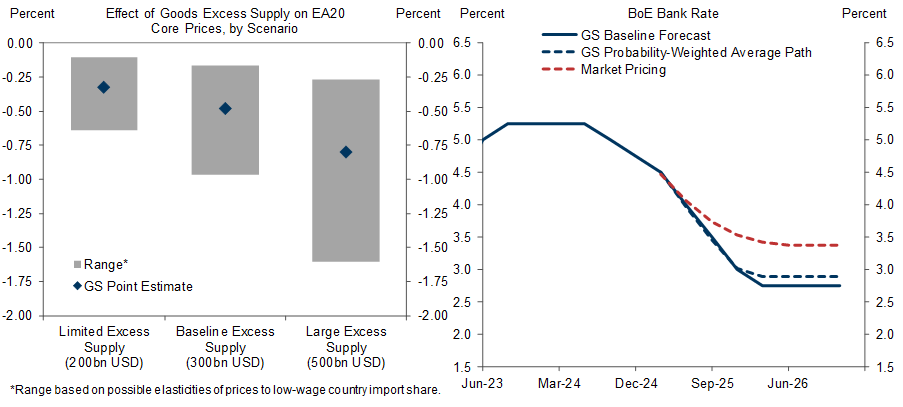

5. Our monetary policy views in Europe remain dovish. Despite modest improvement in the manufacturing PMIs and an upside surprise in the flash core HICP in April, we remain confident that the inflation trend is still down, in part because of redirected goods supply from China. We expect three more sequential 25bp cuts from the ECB to 1.5%, with risks tilted toward bigger and/or deeper cuts. Across the Channel, inflation remains stickier but leading indicators such as job openings, pay settlements, and natural gas futures point to meaningful deceleration later this year. With the growth outlook also deteriorating—note the sharp decline in the PMIs in April—we have doubled down on our dovish BoE call and now expect sequential 25bp cuts until Bank Rate hits 2.75% in February 2026; this keeps us well below market pricing at that horizon.

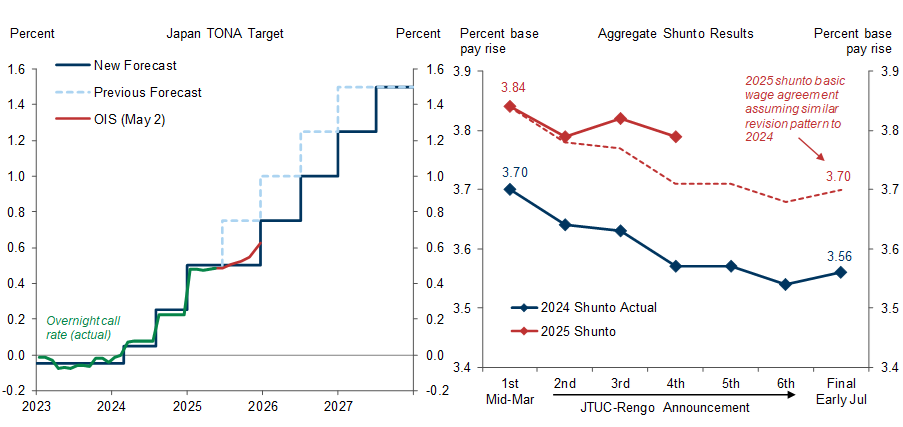

6. Governor Ueda’s press conference after the latest Monetary Policy Meeting led us to delay our forecast for the next BoJ hike by six months to January 2026. We think the BoJ is very sensitive to the risk of having to push back its timeline for a return of underlying inflation to the 2% target, making a near-term rate hike unlikely at least until trade policy uncertainty has abated from its extreme current level. However, we have not changed our terminal policy rate forecast of 1.5%, partly because indicators such as wage growth and inflation expectations continue to look encouraging. We would also note that the most recent Tokyo CPI prints have surprised to the upside, though this partly reflects the transitory impact of free school tuition policies.

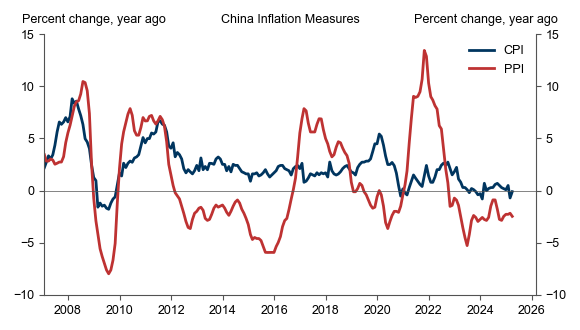

7. China’s PMIs surprised on the downside in April and the extent of any further macro policy easing is unclear. Nevertheless, we still feel fine about our limited 2025 growth downgrade from 4.5% to 4.0%. Trade-related data thus far, including both freight volumes and surveys of listed companies, suggest that Chinese producers are rerouting their exports to the US via third countries and shifting exports to other markets. The apparent resilience of exports allows the government to be patient and withhold additional easing for now. However, the trade war remains a deflationary force for the Chinese economy, and inflation remains below consensus, below target, and (at least for the PPI) below zero.

8. This is a tricky time for investors. While the economy has held up a touch better than expected so far, it’s very early and risk asset markets have already taken a lot of credit for the modest surprise. Further relaxation is certainly possible, especially if we do see trade deals over the next few weeks, but our equity, credit, and cross-market strategists are wary of chasing the rally on the eve of what looks likely to be significant price hikes, supply chain disruptions, and job losses. Our strongest views across markets remain a weaker dollar and a higher gold price. Beyond these two, we are bullish on UK rates, copper, and US natural gas, but bearish on oil.

Jan Hatzius

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.