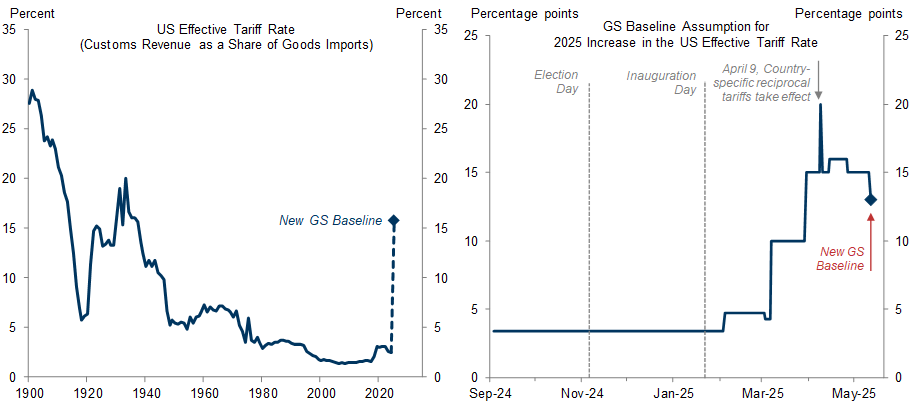

The Trump administration announced a 90-day pause in the retaliatory tariffs imposed in April, which will leave the US and China with 2025 tariff increases of +30pp and +15pp, respectively. While we had expected a de-escalation, the rate is lower than the +54pp tariff hike we had penciled into our baseline.

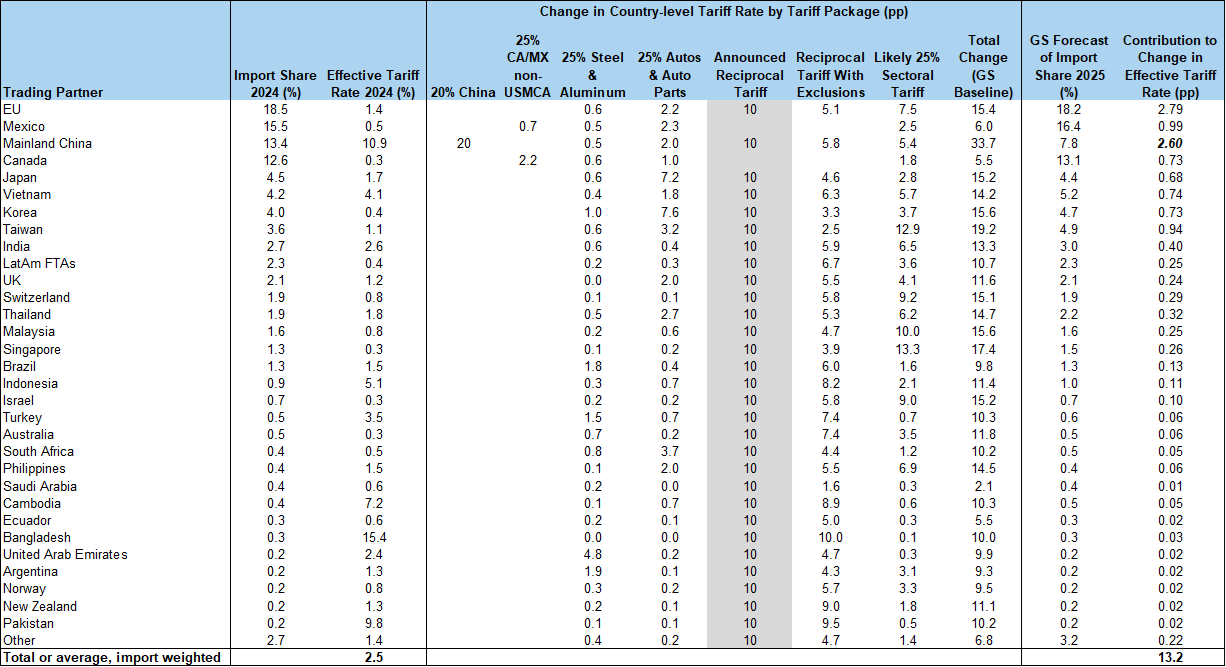

We expect this move to leave the US effective tariff rate increase at +13pp, assuming that likely sectoral tariffs on pharmaceuticals and semiconductors take effect, slightly below our previous assumption of +15pp.

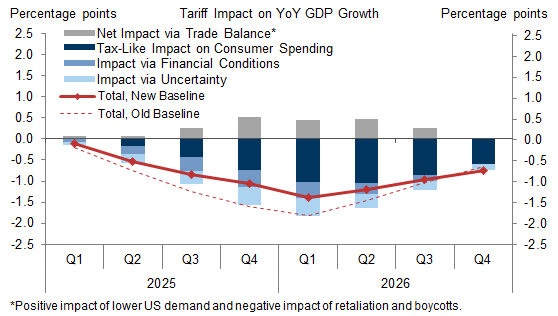

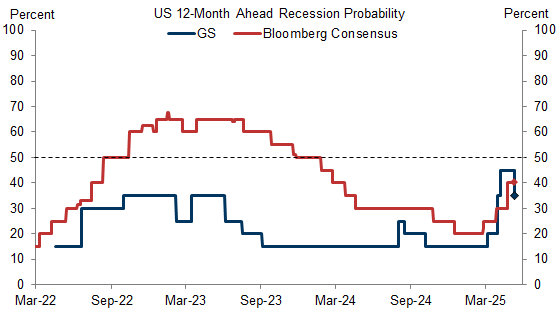

In light of these developments and the meaningful easing in financial conditions over the last month, we are raising our 2025 growth forecast by 0.5pp to 1% Q4/Q4 and reducing our 12-month recession odds to 35%.

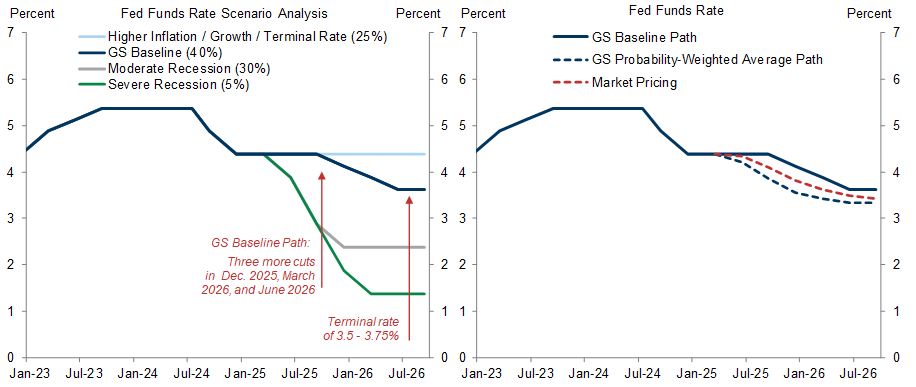

Under our new economic baseline, the rationale for rate cuts shifts from insurance to normalization as growth remains somewhat firmer, the unemployment rate rises by somewhat less, and the urgency for policy support is reduced. We expect the Fed to begin a series of three cuts later than we had previously expected (Dec. vs. our prior expectation of July) and to implement them at every other meeting rather than sequentially.

Raising Our Growth Forecast and Lowering Our Recession Odds in the Wake of a US-China Trade Deal

Jan Hatzius

David Mericle

Alec Phillips

Ronnie Walker

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.