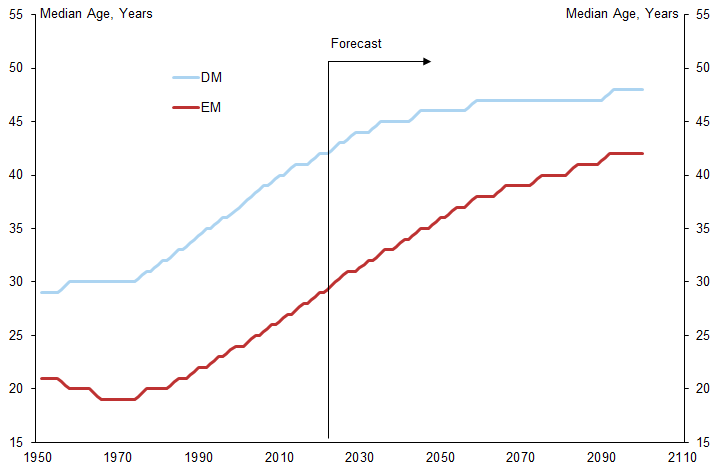

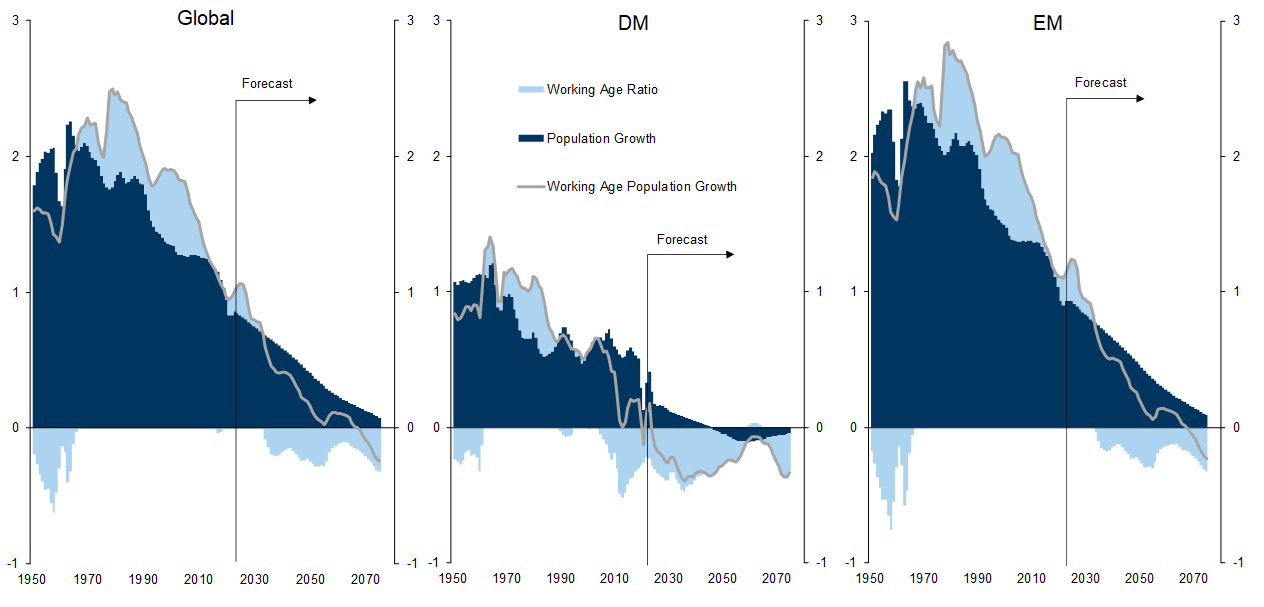

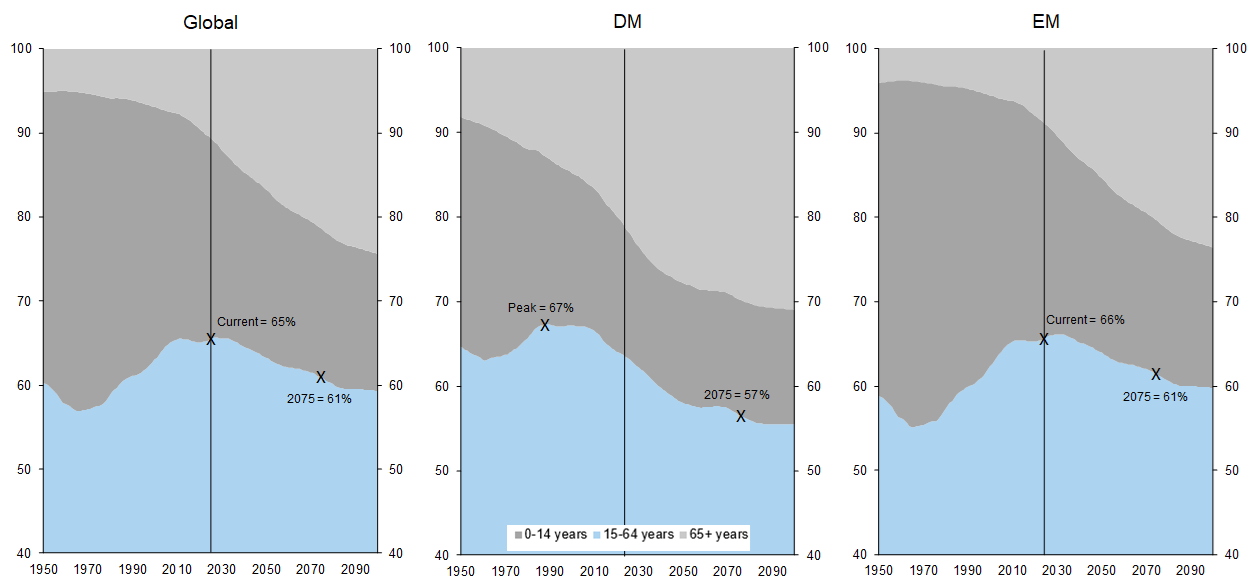

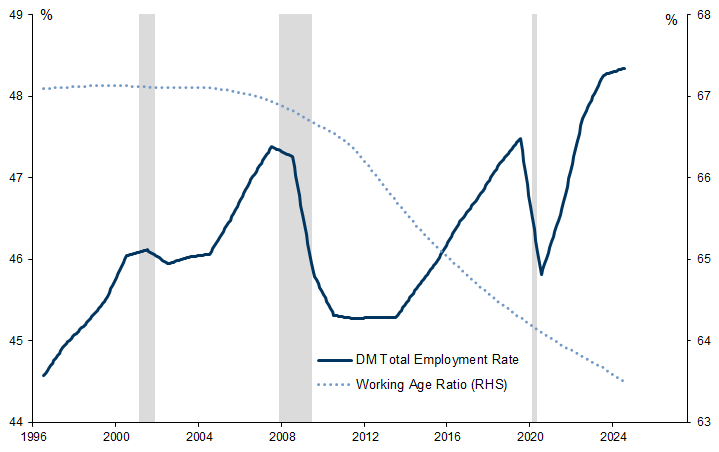

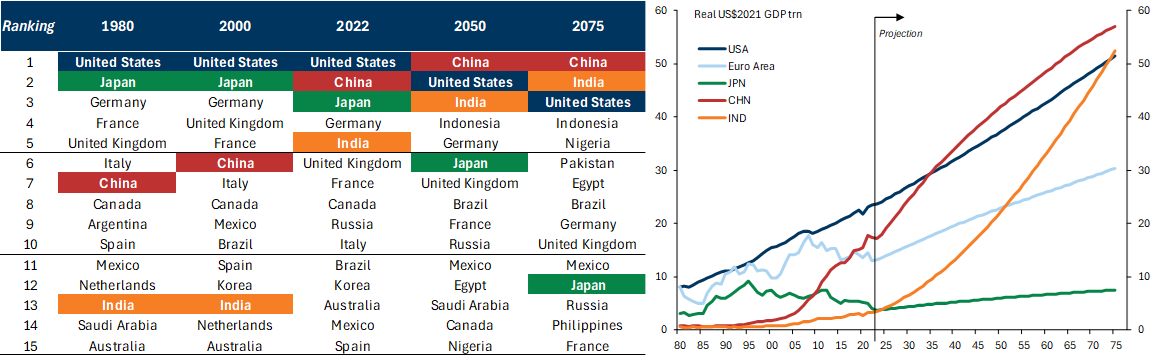

The global population is aging, driven by a combination of increased longevity and declining fertility. This phenomenon is most pronounced in developed (DM) economies, where the ‘working-age ratio’ (ages 15-64) has already decreased from 67% in 2000 to 63%, and is projected to fall to 57% by 2075. In emerging economies, the 15-64 share is close to a peak (66%) and is expected to decline to 61% over the next 50 years. This process of aging is often depicted as a ‘demographic time bomb,’ implying rising dependency ratios (i.e., a fall in total employment rates) and declining GDP per capita.

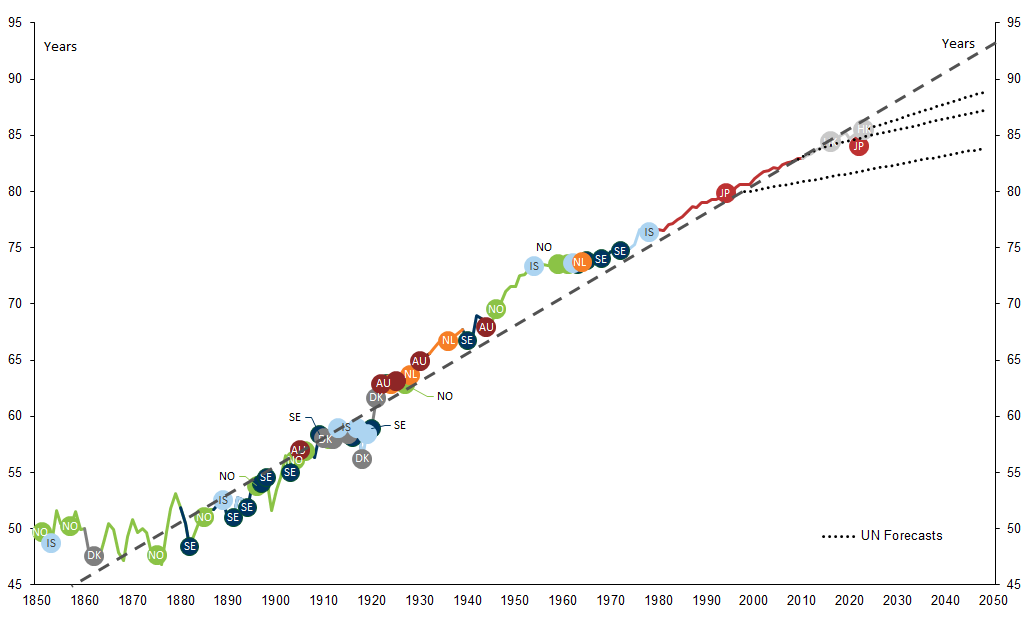

While it is right to focus on the economic implications of a transition of this importance, economists should not lose sight of the fact that increasing life expectancy is a fundamentally positive development. In addition to living longer, people are also living healthier lives, in the sense that the functional capacity of older individuals is improving over time. According to a recent comprehensive study, a person who was 70 in 2022 had the same cognitive ability as a 53-year-old in 2000. In a very tangible sense, 70 is the new 53.

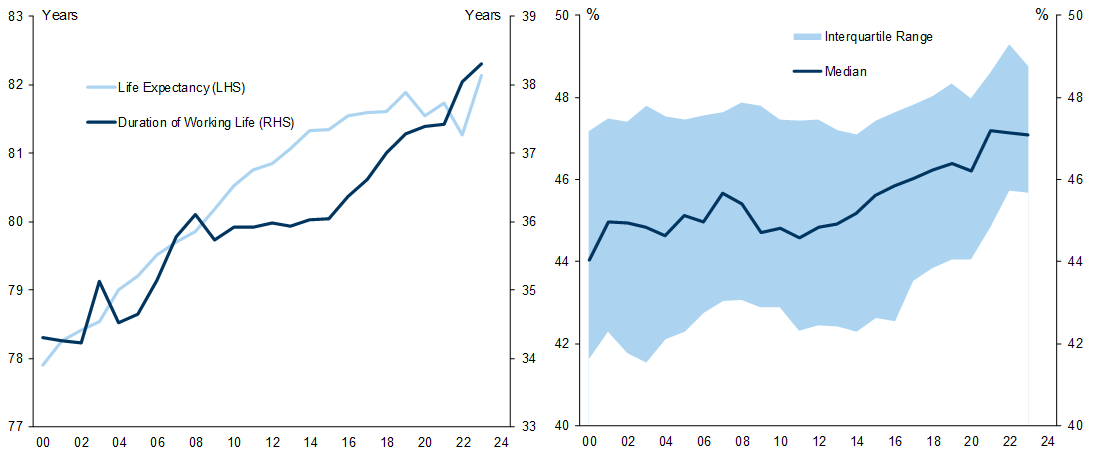

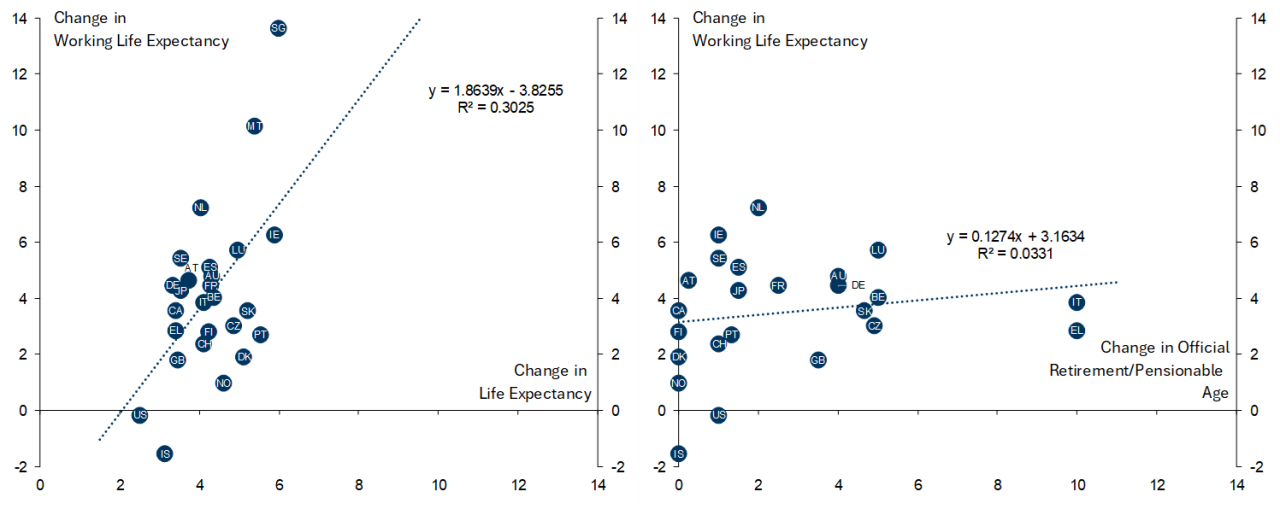

It is also far from clear that the economic drawbacks of population aging are as intractable as they are commonly depicted. Although rising public sector pension costs remain a concern for some economies, the most effective means of counteracting the impact of aging on dependency ratios is to extend working lives. Fortunately, this trend is already in motion: while median expected life expectancy in developed economies has increased by 5% since 2000 (from 78 to 82 years), the median effective working life has risen by 12% (from 34 to 38 years) and the share of the total population in employment has increased from 46.0% to 48.3%. In other words, despite the large decline in DM working-age ratios that has already taken place, DM dependency ratios have actually fallen. This trend towards extending working lives shows little sign of abating and is taking place in countries with minimal changes to pension laws, suggesting an adaptive response to increased longevity.

In a world with a growing number of seemingly intractable problems – from climate change to economic populism – population aging is one less thing to worry about. Living longer really is a good thing.

The Path to 2075 — The Positive Story of Global Aging

The World’s Aging Population

1. Increased Longevity

2. Declining Fertility

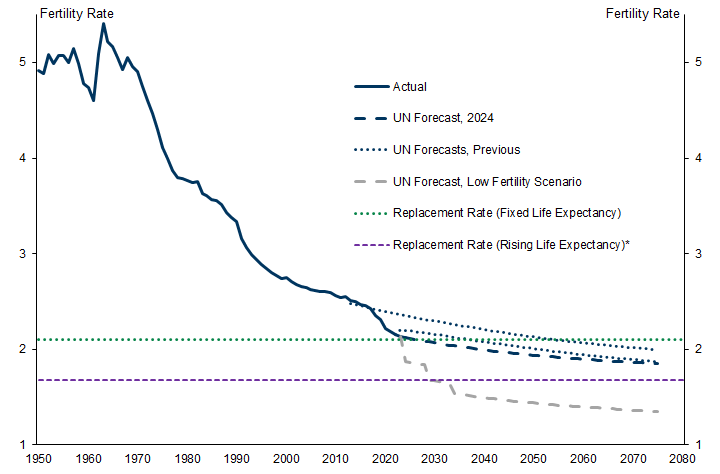

Exhibit 3: The Global Fertility Rate Has Fallen from a Peak of 5.4 in 1963 to 2.1 in 2024

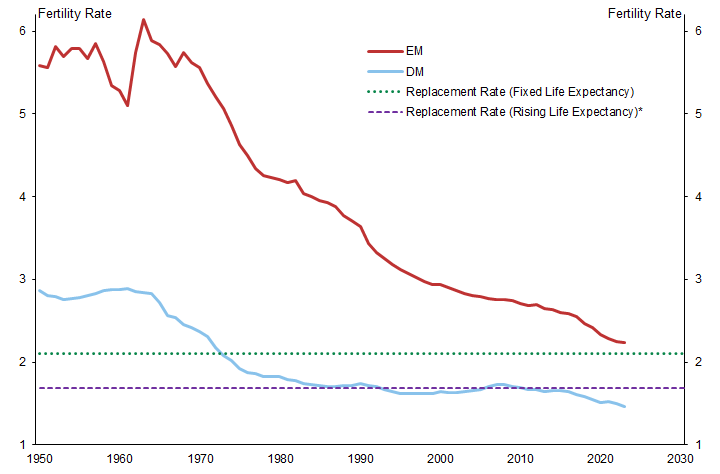

Exhibit 4: The Decline in Fertility Rates Has Been Greatest in EM Economies, While DM Fertility Has Been Below the 'Replacement Rate' (Assuming Fixed Life Expectancy) for More than 50 Years

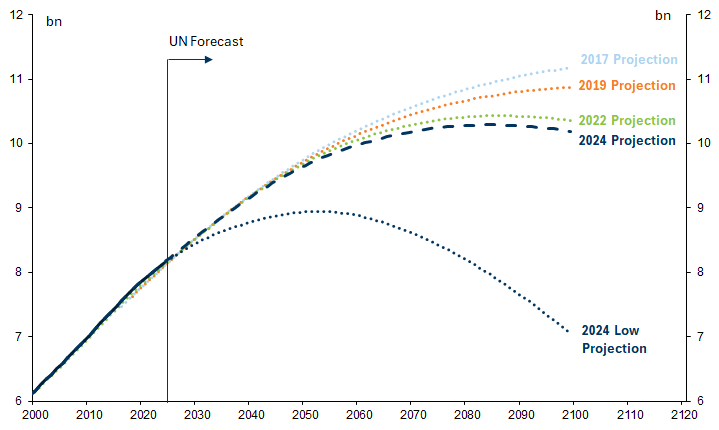

Exhibit 5: The Projected Peak in Global Population Has Declined Due to Lower Fertility But, Even Under a Low Fertility Assumption, the World's Population Will Rise from Around 8bn to 9bn in 2050

A Global ‘Demographic Time Bomb’

Defusing the Time Bomb: Extending Working Lives

The Good News: We Are Already Working Longer

Exhibit 8: The Increase in Working Lives in DM Economies Has Matched the Increase in Life Expectancy, Resulting in an Increase in the Share of Our Lives in the Labor Market

Exhibit 9: Effective Working Lives More Closely Linked to Longevity than Official Pension Age

Exhibit 10: The DM Total Employment Rate Has Risen (Implying A Lower Dependency Ratio), Despite a Large Decline in the Working Age Ratio

We Look Good for Our Age

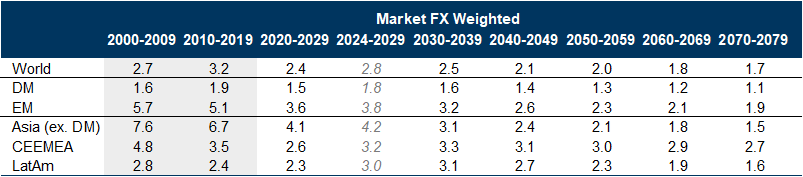

Box 1: The Path to 2075 – Long-term Projections for the Global Economy

Box 2: Calculating Working Life Duration Estimates for DM and EM Economies

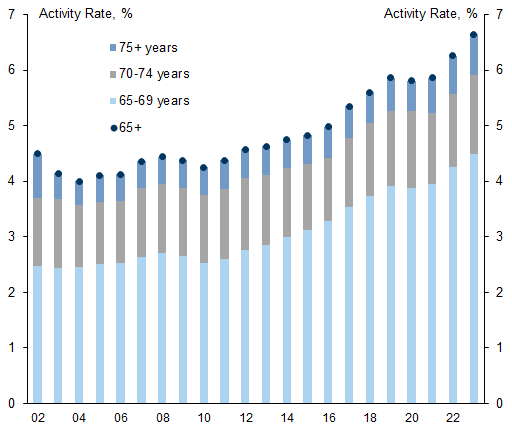

Exhibit 13: Distribution of Activity Rates for People Aged 65+ is Heavily Skewed Towards those in their Late 60s and Early 70s

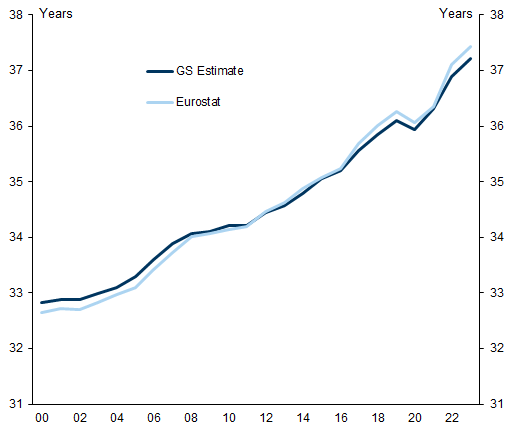

Exhibit 14: Our Estimate for Working Life Duration in the EU Tracks Well with Eurostat's Official Measure

Bibliography and Thanks

- 1 ^ We use the standard financial market classification for DM economies. Our classification of EM economies includes all countries not included in the DM group – i.e., we do not distinguish between ‘emerging’, ‘developing’ and ‘frontier’ economies. The countries in this broad EM group account for a large majority of the global population (currently 87%) but a much smaller share of global GDP (40%, at market exchange rates).

- 2 ^ These projections are made in World Population Prospects, which is a biennial report from the United Nations presenting historical demographic data starting from 1950, as well as projections (until 2100 in the latest report) for 237 countries or regions. The most recent report was published in July 2024.

- 3 ^ The life expectancy figures we quote are for total population (men and women). Life expectancy is typically higher on average for women than for men, although the gender gap in life expectancy has been declining over time in both developed and emerging economies.

- 4 ^ The standard method for reporting life expectancy data is based on the ‘period life expectancy’ approach, which calculates the average number of years a person can expect to live based on the current mortality rates at a specific point in time. ‘Cohort life expectancy’ estimates, on the other hand, aim to account for future changes in mortality. While ‘cohort life expectancy’ estimates are inherently subjective, they tend to offer a more realistic assessment than forecasts that assume zero future improvement in mortality rates.

- 5 ^ This represents a likely ‘best case’ scenario because a significant portion of the increase in life expectancy over the past 150 years can be attributed to the reduction of early-life mortality rather than extending the upper limit of human lifespan. Given the high rates of survival to old age in developed countries, the potential for further gains of this type is more limited. This implies a probable slowdown in the rate of increase in longevity in the frontier over time. See Ashwin and Scott (2025).

- 6 ^ These results are based on an empirical analysis using almost one million observations for individuals aged 50-90 in 29 advanced economies (AEs) and 12 emerging market economies (EMs) during 2000–22. Physical and cognitive abilities are compared over time, having controlled for differences in other co-variates, including socioeconomic characteristics (such as education and wealth) and cross-country effects. See IMF (2025), ‘The Rise of the Silver Economy: Global Implications of Population Aging.’

- 7 ^ The distinction between focusing on the implications of an 'aging economy' and a 'longevity economy' is one that is emphasized by Scott (2023).

- 8 ^ To replace themselves (assuming fixed mortality rates), women, on average, need to have one female child who survives long enough to have a female grandchild. The reason this replacement rate is 2.1 rather 2.0 is (i) not all women will live to the end of their reproductive age and (ii) the sex ratio at birth is usually around 105 males born for every 100 females. In countries with high early-life mortality rates or where there are more than 1.05 males born for every female, the fixed-mortality replacement rate is higher than 2.1.

- 9 ^ Increasing life expectancy results in a ‘drift’ in mortality, which reduces the number of deaths per year relative to a population with fixed life expectancy. All else equal, a 0.25 per year increase in life expectancy will reduce the number of deaths per year by 1/(1+0.25) relative to a population whose life expectancy is fixed, reducing the replacement rate from 2.1 to around 1.6-1.7. Given that global life expectancy has been rising at a faster rate than this (0.32 per year), the fertility rate that has historically corresponded to zero population growth has been even lower, at around 1.5-1.6.

- 10 ^ Immigration from EMs has also contributed to DM population growth but, even excluding immigration, DM population growth would have been positive over the past 50 years, despite an average fertility rate that has consistently been well below 2.1.

- 11 ^ The UN population projections also assume a very slow increase in life expectancy, which has consistently been exceeded by reality. If life expectancy continues to surprise to the upside, this implies upside risks to its population projections.

- 12 ^ Concerns over the implications of population growth date back to Thomas Malthus (1798). Malthus argued that exponential population growth, combined with linear growth in food supply and other resources, would result in a Malthusian Trap and population decline. At the time of writing, the global population is estimated to have been around 1 billion people. Malthus was wrong because growth in food supply and other resources also proved to be exponential. However, while global food supply has more than matched population growth to date, there are limits on the extent to which this is likely to be true in the future and there have been a number of more recent studies warning of the consequences of continued global population growth (see, for example, Ehrlich (1968) or Brown (2012)).

- 13 ^ Fernández-Villaverde (2021) is a notable proponent of the more negative interpretation of declining fertility trends. Our view is more benign than his on this point for two reasons: first, he does not adjust the replacement rate for increases in longevity; second, he takes a more pessimistic view of the likely trajectory of future fertility, arguing that countries where fertility is exceptionally low represent a likely template for the rest of the world. Nevertheless, even on this basis, he still expects the global population to continue growing until ‘between 2050 and 2060’.

- 14 ^ The total-population employment rate is the share of the entire population that is employed, unlike standard employment rate measures in which a measure of the working-age population is used as the denominator. The ‘dependency ratio’ is given by 1 – total-population employment rate.

- 15 ^ As we will discuss, it is not reasonable to assume that employment rates rise and fall on a one-for-one basis with changes in the working-age ratio. However, this assumption is implicit in most studies of the economic effects of population aging.

- 16 ^ Cross-country migration can offset the effects of population aging in countries where fertility is particularly low, but does not provide a solution to global aging.

- 17 ^ Although we have constructed the data for both developed and emerging market economies, our analysis primarily focuses on DM economies, where working-age ratios have already significantly declined.

- 18 ^ Although not the focus of our analysis, it is worth noting that the average number of years people spend in education has also been increasing over time. As life expectancy rises, all stages of life are extending, making it logical for individuals to both lengthen their time in the workforce and invest more years in education.

- 19 ^ Daly, K (2007), ‘Gender Inequality, Growth and Global Ageing’, Goldman Sachs Global Economics Paper (April 3, 2007)

- 20 ^ “The Path to 2075 — Slower Global Growth, But Convergence Remains Intact”, Goldman Sachs Global Economics Paper, 6 December 2022.

- 21 ^ Because of the large swings in GDP growth generated by the Covid pandemic, the 2024-29 column provides the cleanest indication of what our model indicates for near-term potential growth.

- 22 ^ Given the recent pessimism around China’s long-term growth prospects, some readers may be surprised that we expect China to overtake the US at this horizon. However, three points are worth bearing in mind in this regard: First, China has already closed most of the gap with US GDP (China's GDP has risen from 12% of the US in 2000 to around 80% currently). Second, despite significant downward revisions, potential growth in China remains significantly higher than in the US on our revised estimates (4.0% vs. 1.9% for 2024-29). Third, in addition to differences in potential growth, we expect some of the US Dollar’s real overvaluation vs. the Chinese Yuan to be unwound over the next 10-15 years.

- 23 ^ Earlier studies in the literature such as Wolfbein (1949) employ a similar concept in estimating length of working life in the US in the 1940s. In more recent times, forensic economists such as Foster and Skoog (2004) and Krueger and Slesnick (2014) have used the so-called Markov increment-decrement model (MID) to estimate working life duration. For more details, see Foster, E and G. Skoog, G (2004). “The Markov Assumption for Worklife Expectancy”. Journal of Forensic Economics, 17 (2), pp. 167 – 183; Krueger, K and F. Slesnick (2014). Total Worklife Expectancy. Journal of Forensic Economics, 25 (1), pp. 51 – 70; Wolfbein, S. L. (1949). “The Length of Working Life”. Population Studies, 3 (3), pp. 286 – 294.

- 24 ^ Loichinger and Weber (2016) used labour force participation rates from the ILO in estimating working life duration in Europe. See, E. Loichinger and D. Weber (2016). “Trends in working life expectancy in Europe”. Journal of Aging and Health, 28 (7) (2016), pp. 1194-1213.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.