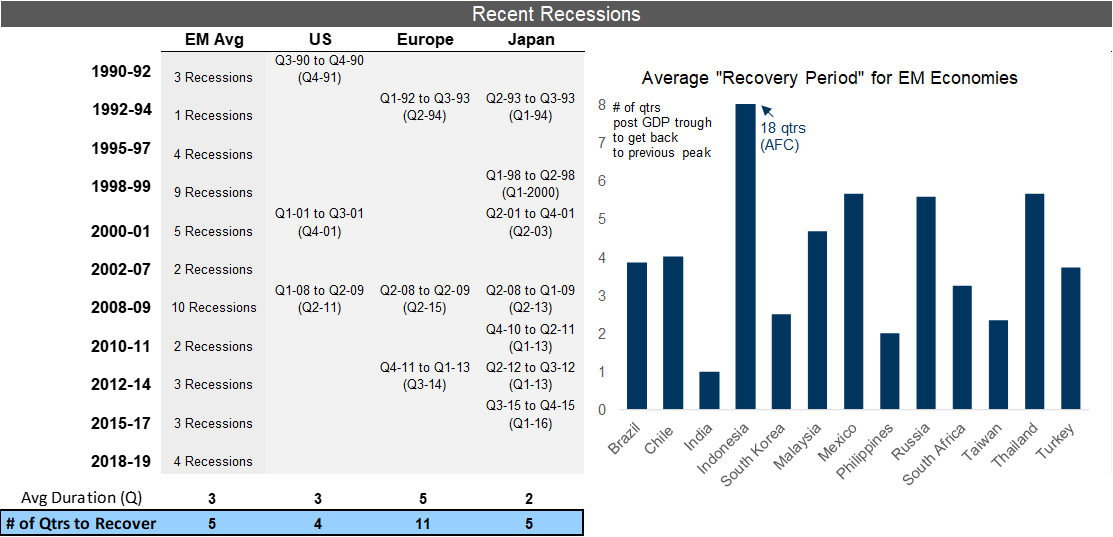

(1) Recession Recovery Paths: The past 30 years offer 46 recessions across the 12 largest EM economies, and history suggests that economies tend to recover previous peaks of output 5 quarters after the end of the recession. There is wide variance across times and geographies, but over 75% have recovered within 5 quarters, suggesting this is a decent rule of thumb for an 'average recovery'.

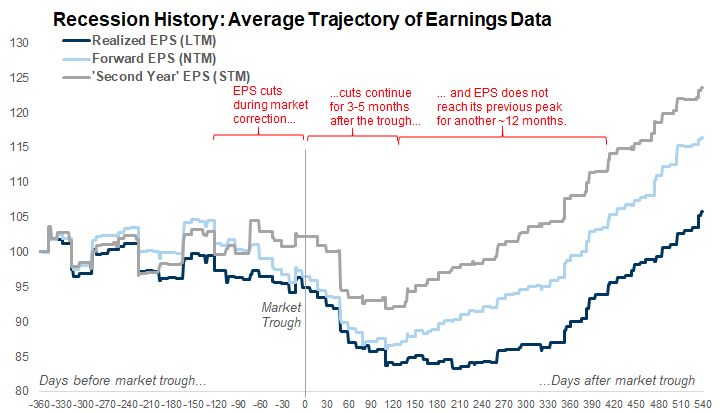

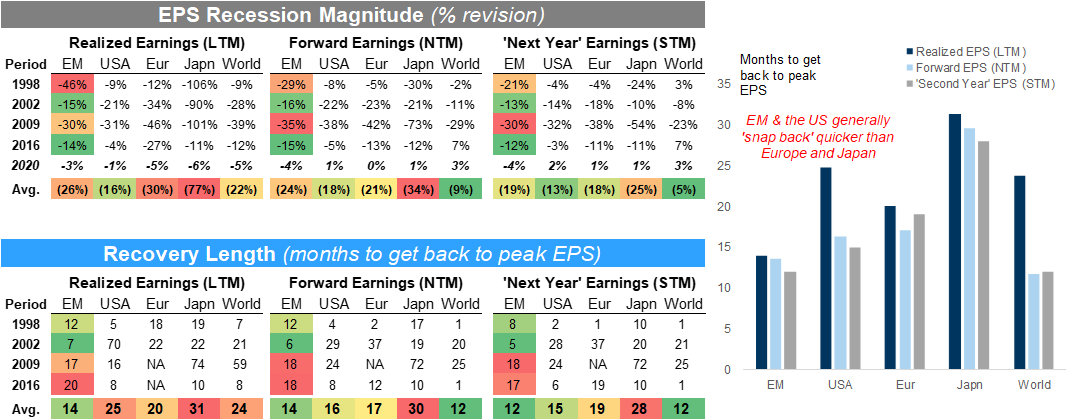

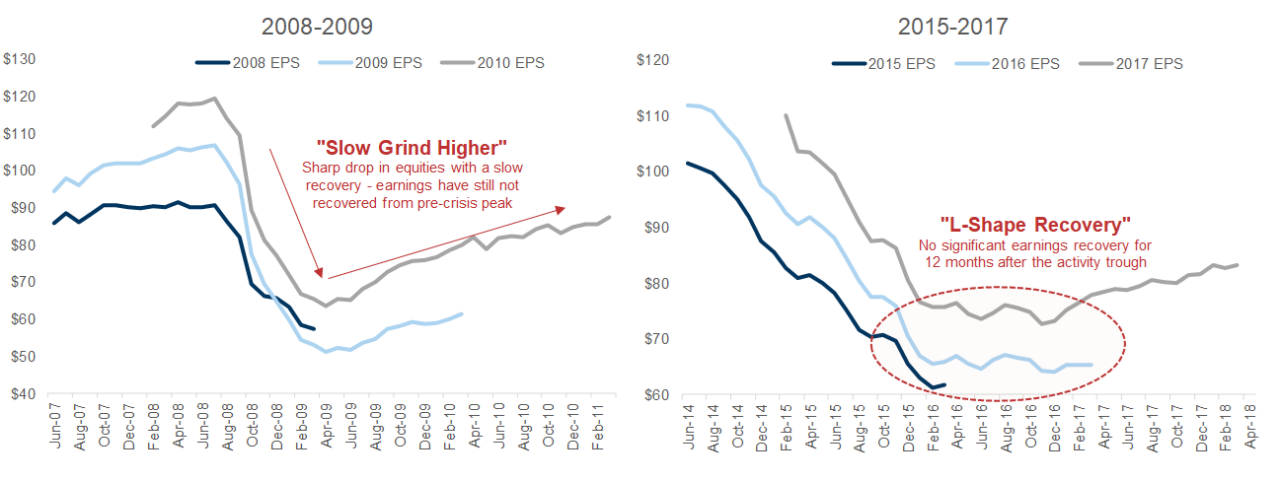

(2) EPS Gauging: At the headline level, EPS trajectories are similar to GDP -- earnings often take roughly 14 months to re-attain the highs preceding a bear market. There is nuance here: forward estimates fall by less and take a shorter amount of time to recover than realized earnings, and these estimates are a better barometer of market performance than realized data.

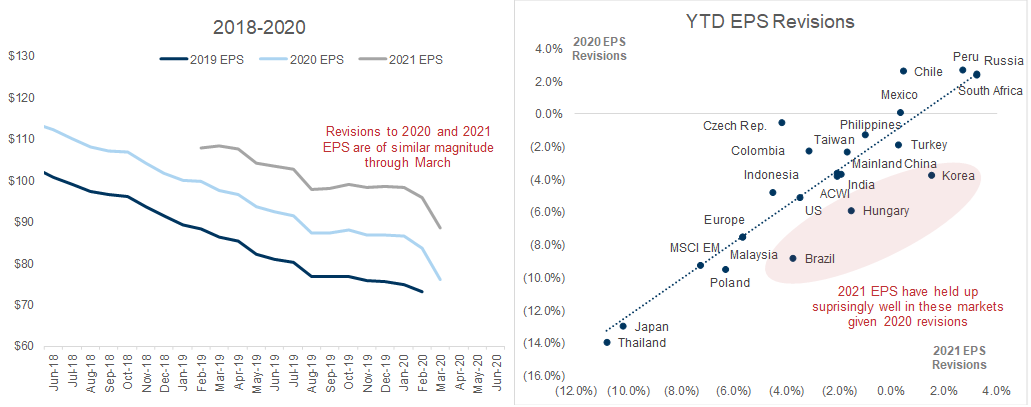

Further nuance in the current environment: investors appear focused on "second year" EPS and the potential for a quick snap-back in 2021 activity. Usually, long-term EPS forecasts are heavily anchored by short-term estimates, but the sudden-stop around the Asia Financial Crisis provides a potential historical analogy (2000 forecasts were flat as 1999 estimates were slashed 14%).

For context, our base-case 2021 MSCI EM EPS forecasts point to a further 6% downward revision to consensus estimates (marking a total 15% downgrade to "long-term" estimates, slightly more than those of 2002 and 2016). These estimates drive our 12-month target of 950 (+6%) for MSCI EM.

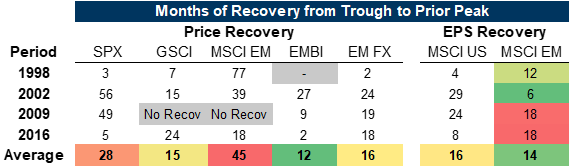

(3) V-Shape, L-Shape, Short-Lived EPS Recessions: Taking an average across previous recessions may not be particularly helpful as the trajectories of the past four episodes have taken on different shapes. We find two important observations for the current environment: first, EM asset rebounds have been dependent on US policy and earnings recoveries (via global risk premia channels); second, there are a few notable EMs where EPS estimates are anticipating a strong rebound in 2021 (Brazil, Korea, and CE-3). These markets have seen downgrades to 2020 estimates that have not been "carried forward" into 2021 as they have been across the rest of EM (and DM for that matter).

To V or Not to V

1. What is a V-Shape Recovery

2. Gauging Expectations - EPS Trajectories into and out of recessions

3. Four Recessions, Four Recovery Shapes: V, L, Short-Lived, Slow Grind

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.