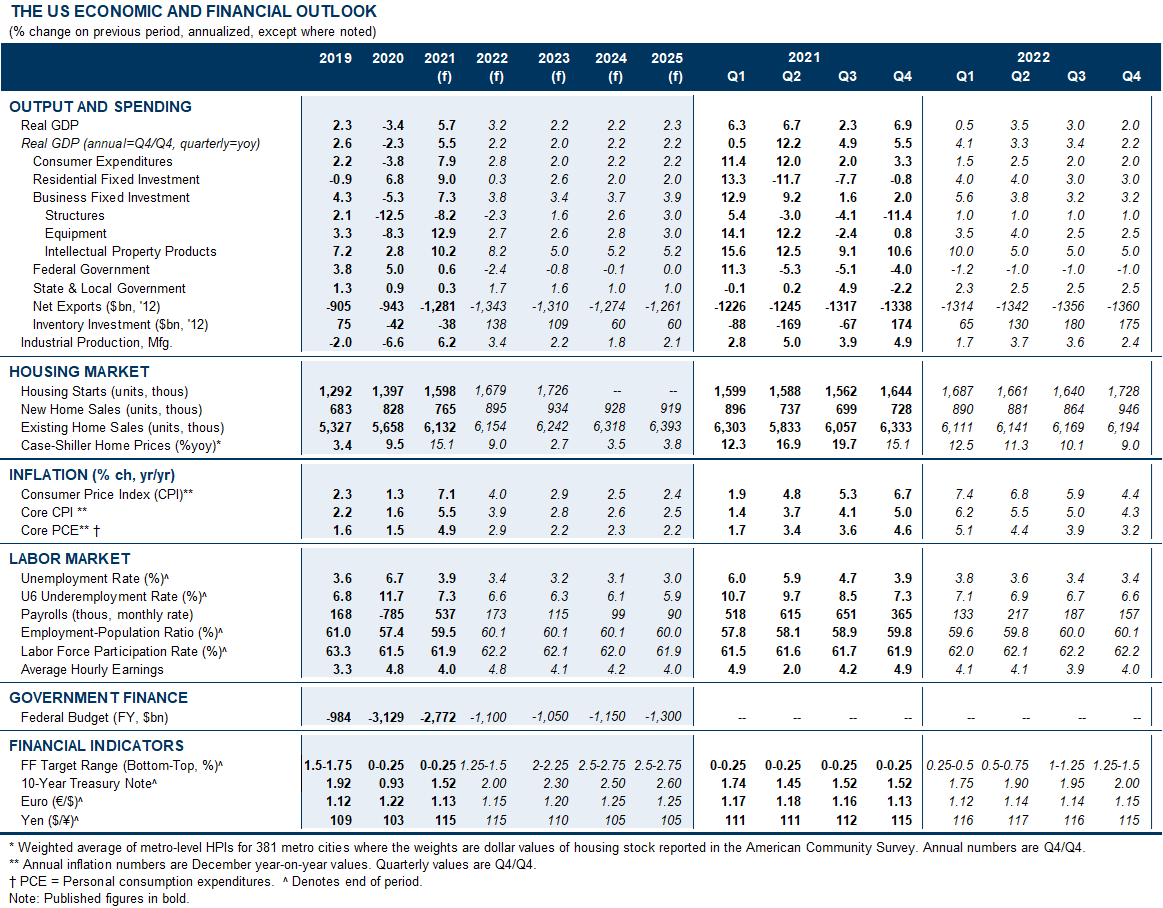

Last week’s GDP report showed blistering growth of nearly 7% in Q4, capping off a year in which GDP grew at the fastest rate since the 1980s. However, growth is likely to slow abruptly in 2022, as fiscal support fades and, in the near term, virus spread weighs on services spending and prolongs supply chain disruptions.

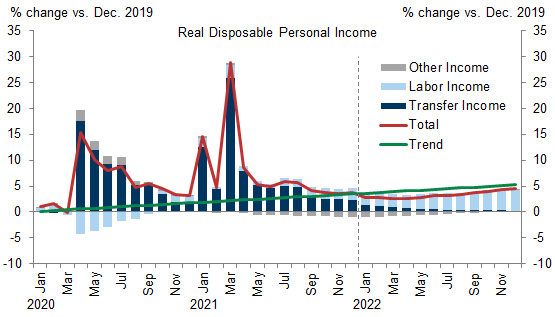

We have long highlighted that the fiscal impulse will fade sharply from 2021 into 2022. Fiscal support boosted real disposable income to 5% above the pre-pandemic trend on average in 2021, but following the lapse of the expanded child tax credit this month, disposable income has likely dipped below trend and, we estimate, will remain an average of 1% below the pre-pandemic trend in 2022—even after penciling in strong gains in labor income.

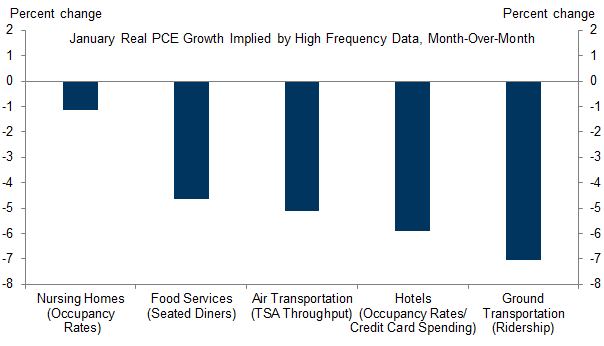

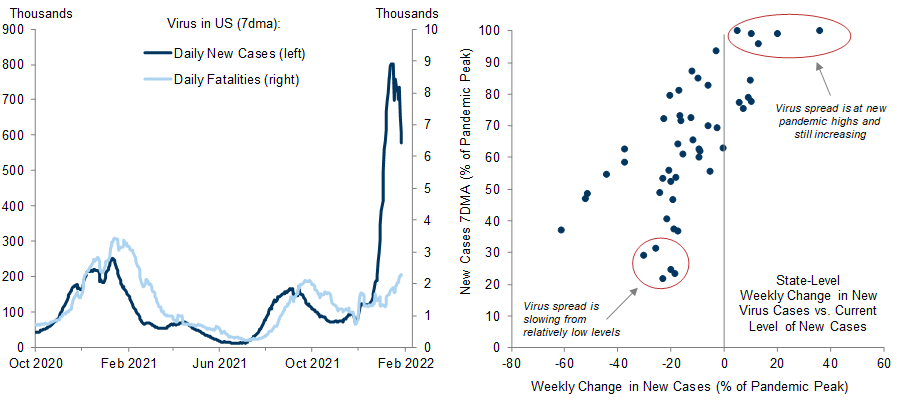

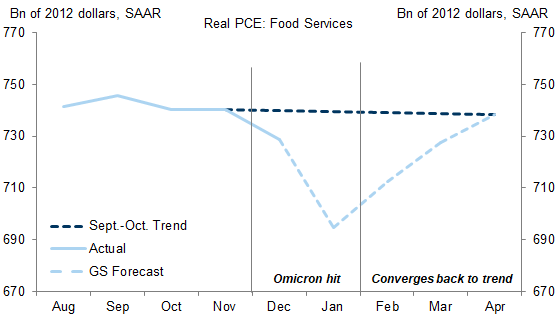

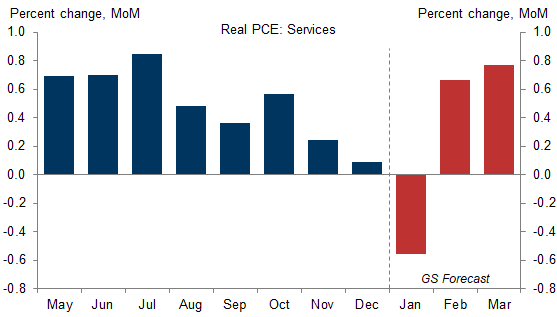

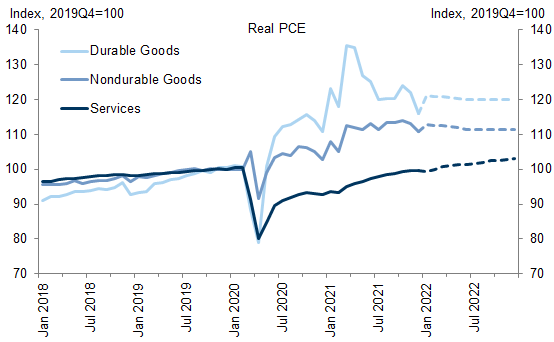

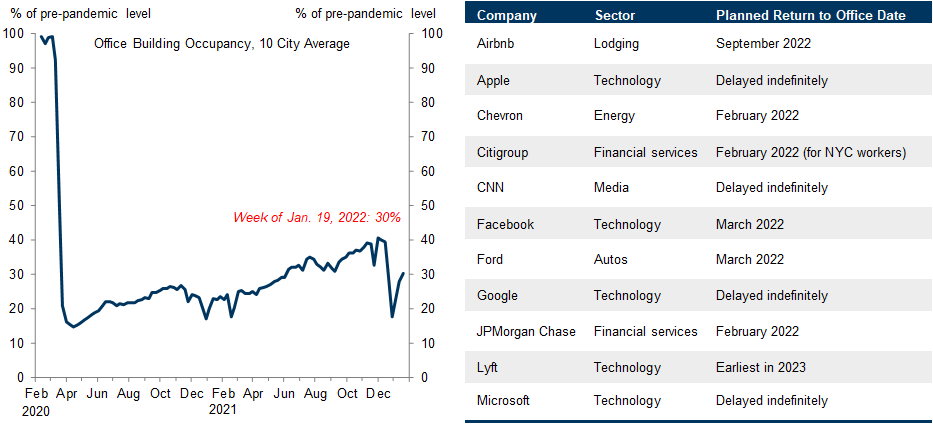

Q1 growth is likely to be particularly soft because the fiscal drag will be accompanied by a hit from Omicron. High frequency data indicate that spending on virus-sensitive services has declined sharply since early December, and we estimate that overall real services spending declined by 0.6% in January. But the rebound from Omicron is likely to be swift, and we estimate that consumption will grow at a modest 1.5% annualized pace in Q1.

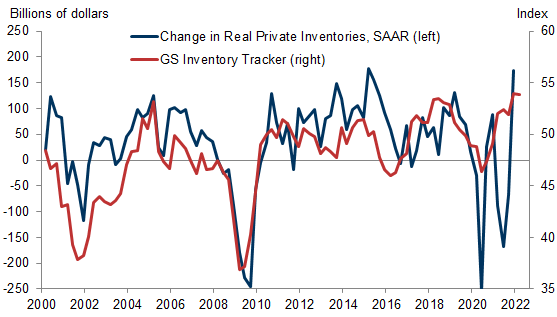

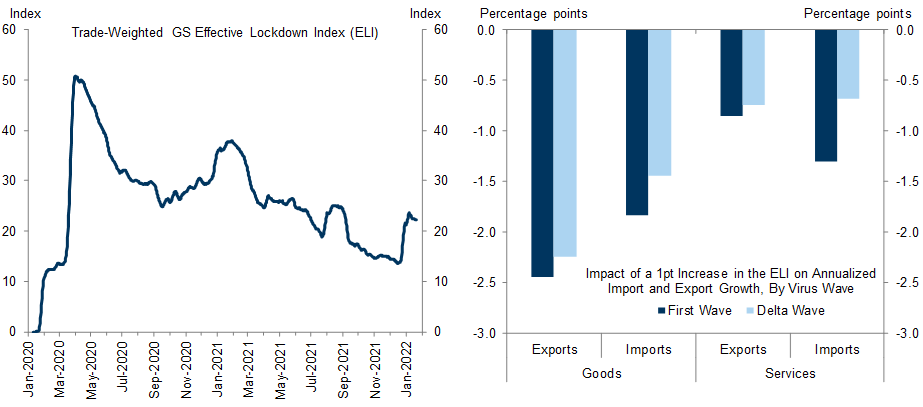

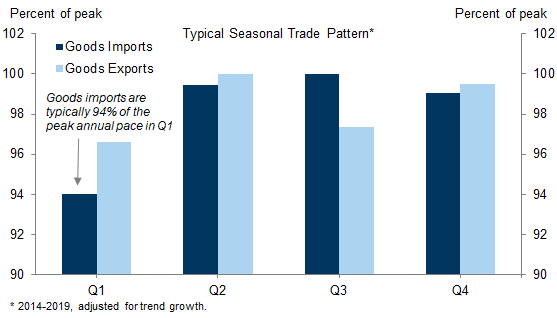

Virus spread has also hit the supply side of the economy. Worker absenteeism appears to have peaked at 3.5% of the adult population in early January, and renewed foreign virus restrictions will likely prolong supply chain disruptions and interrupt domestic production. This is likely to weigh on inventory accumulation and exports in Q1.

Based on our new analysis, we now expect annualized real GDP growth of +0.5% in Q1 (previously +2.0%), +3.5% in Q2 (previously +3.0%), +3.0% in Q3, +2.0% in Q4, and +2.2% in 2022 Q4/Q4 (previously +2.4%). On an annual average basis, our GDP growth forecast is now +3.2% (vs. +3.8% consensus) in 2022.

One Step Back, Two Steps Forward: Q1 Growth and Omicron

Another Bump in the Road to Service Sector Recovery

Virus Spillovers to Inventories and Trade

Our Updated GDP Forecasts

Ronnie Walker

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.