Business investment has grown a solid 3½% over the last year, defying consensus forecasts for the sharp declines usually seen in recessions. However, weak business sentiment, banking stress, and falling office investment threaten to slow capex growth going forward. In this note, we assess the outlook and discuss how these three headwinds will affect capex.

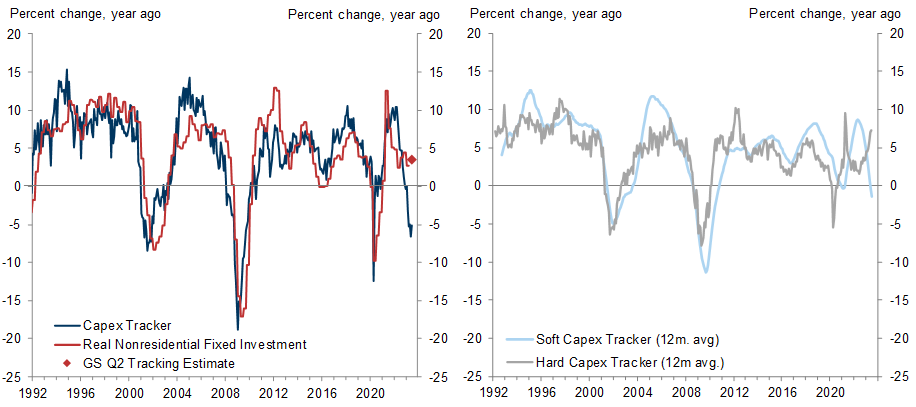

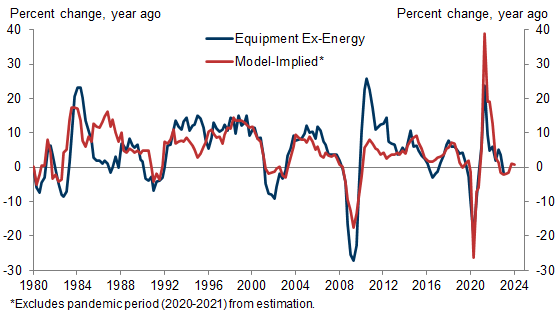

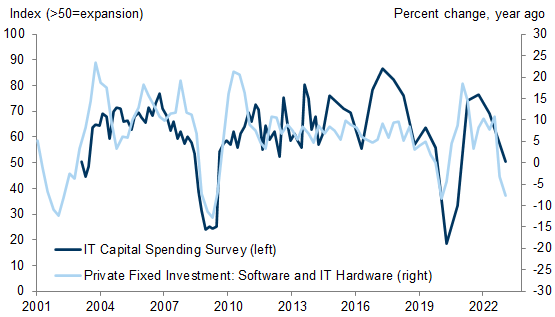

First, forward-looking survey measures of capital spending expectations have fallen to their lowest levels since the financial crisis and are currently in contractionary territory. However, hard indicators on spending plans have not fallen as sharply, and a tracker based on capex-specific hard data—which has historically been a better predictor of realized capex than a soft data equivalent—has remained in expansionary territory throughout this year.

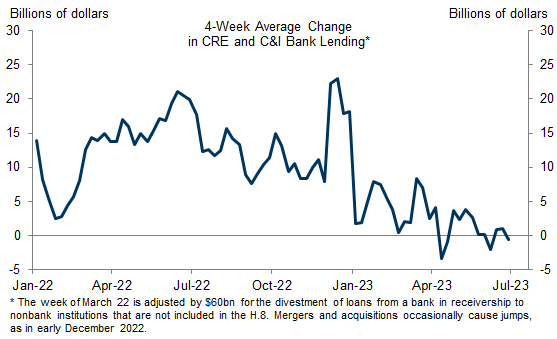

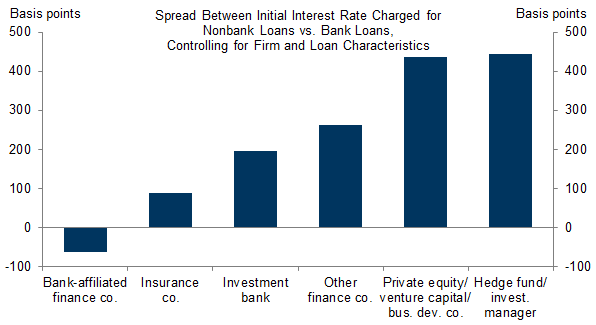

Second, the Fed’s H.8 release indicates that bank lending to businesses has stagnated in recent weeks. The slowdown in bank lending poses an acute threat to structures investment, as commercial real estate is particularly exposed to bank lending, and academic research suggests that alternative financing options can be several hundred basis points more expensive. But reassuringly, small businesses report in the NFIB survey that they have not had a harder time accessing credit since the bank failures.

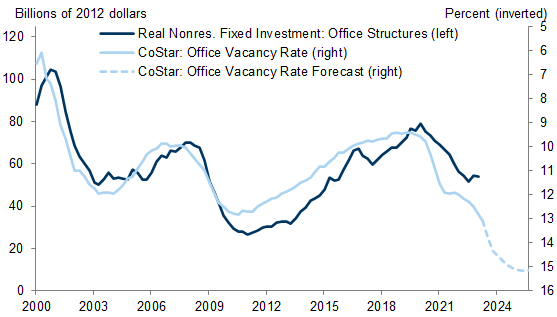

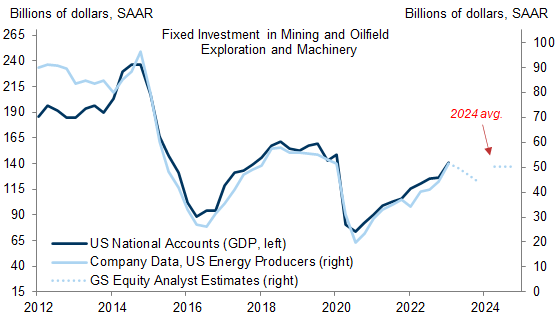

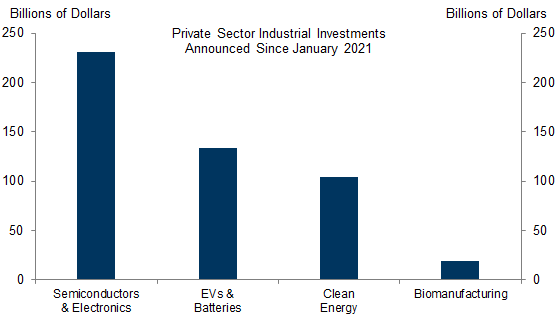

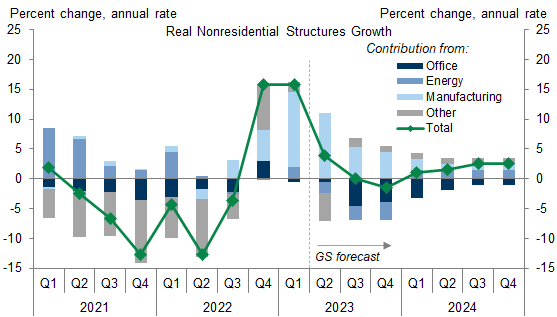

Third, the fundamental backdrop for some segments of structures investment remains weak. Office investment is likely to fall further because office vacancy rates have continued to increase sharply, and guidance from energy companies suggests that oil and gas investment will continue to decline. However, strong investment in domestic manufacturing incentivized by the CHIPS Act and the Inflation Reduction Act should at least partly offset these headwinds. Over the last two years, companies have pledged to spend $365bn in new semiconductor and battery investments, of which we estimate less than one-fourth has been spent.

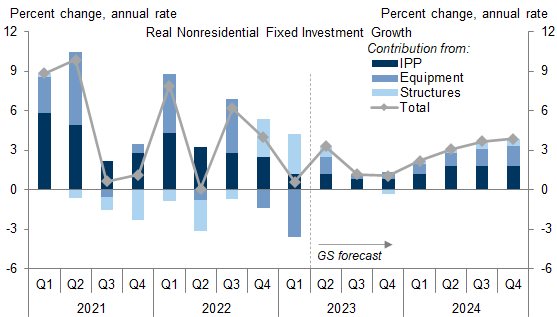

Structures investment growth looks likely to turn slightly negative after increasing 3.1% over the last year. Equipment investment growth is likely to rebound after a 1.2% decline last year as the drags from tighter financial conditions and fears of imminent recession fade. Intellectual property product investment looks likely to slow from the +6.2% pace of the last year, as company guidance suggests businesses are limiting growth in IT investments amid uncertainty about the economic outlook and after pulling forward demand in the immediate aftermath of the pandemic.

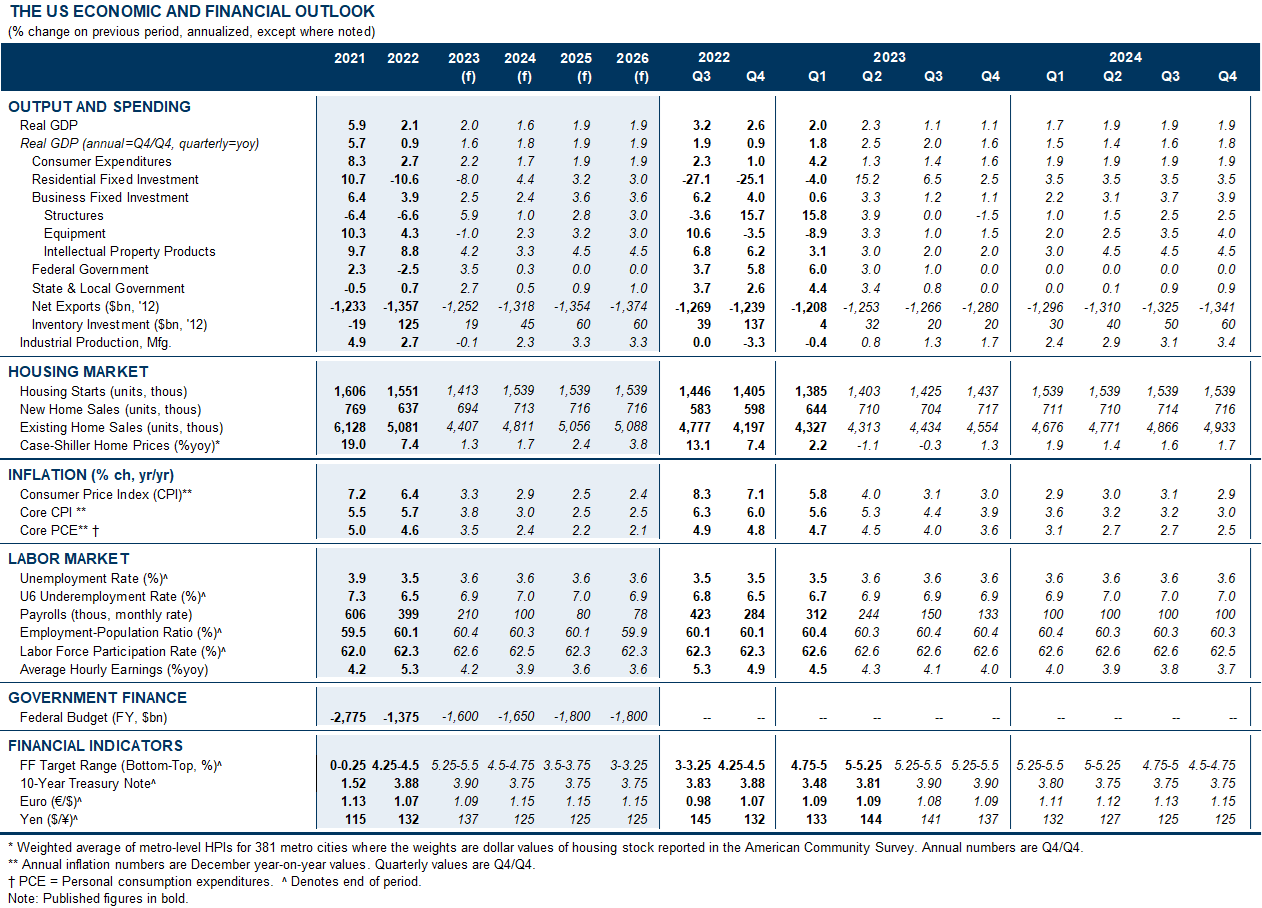

Taken together, we expect that business fixed investment growth will slow from a +2% annualized growth rate in 2023H1 to a roughly +1% annualized rate in 2023H2, before rebounding to a +3% rate in 2024. We now expect GDP growth of 2.3%/1.1%/1.1% in 2023Q2-Q4. Our new path translates to 2023 GDP growth of 2.0% on a full-year basis (vs. consensus of 1.3%) or 1.6% on a Q4/Q4 basis.

Why Depressed Sentiment, Bank Stress, and Empty Offices Won’t Derail Capex Growth

A Tale of Three Headwinds

Equipment Rebounds First, Then IPP

Ronnie Walker

- 1 ^ Sergey Chernenko, Isil Erel, and Robert Prilmeier, “Nonbank Lending,” 2018.

- 2 ^ John Graham, “Presidential Address: Corporate Finance and Reality,” 2022.

- 3 ^ We are reporting an employment-weighted rate across the information, financial services, and professional and business services industries.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.