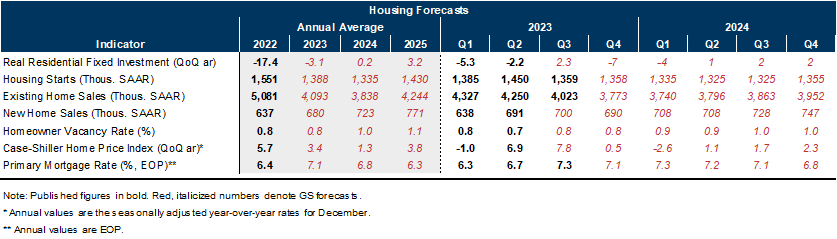

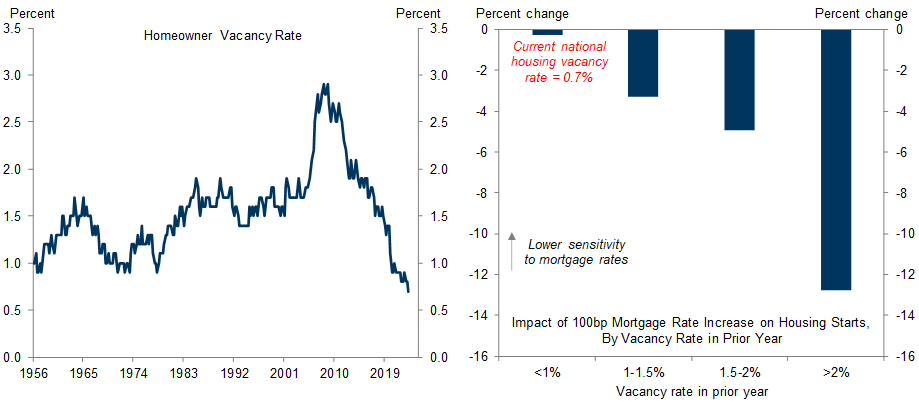

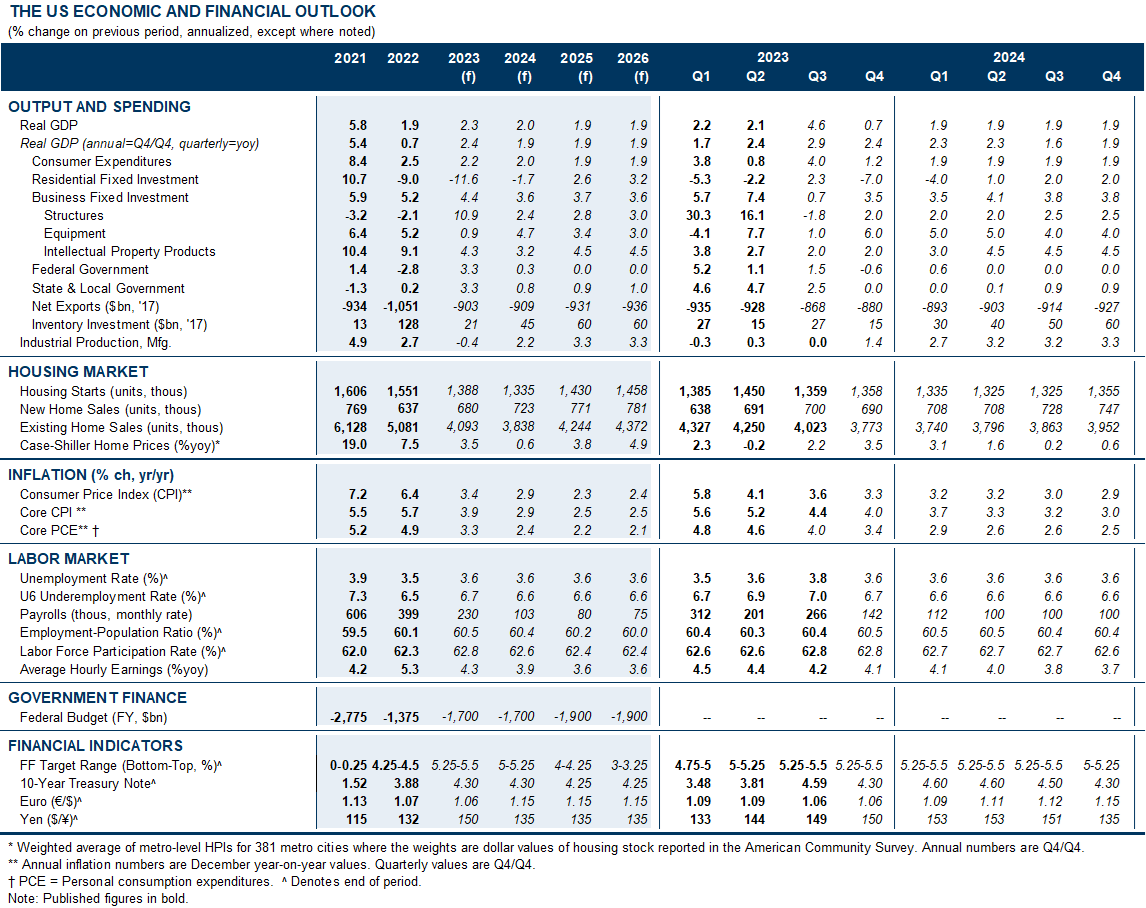

While the sharpest declines in housing activity and prices are now long behind us, the recent jump in mortgage rates and the prospect that they are likely to remain elevated for the foreseeable future present headwinds to the economy’s most interest rate sensitive sector. In this week’s Analyst, we summarize our outlook for the housing market for the rest of this year and 2024.

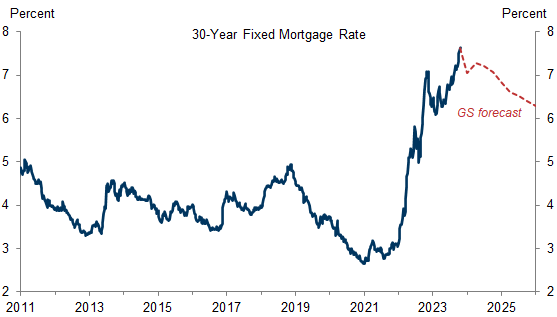

Sustained higher mortgage rates will have their most pronounced impact in 2024 on housing turnover. Nearly all mortgage borrowers have interest rates below current market rates, almost 90% have rates 2pp below, and over 60% have rates 4pp below, strongly disincentivizing them from moving. As a result, we expect the fewest annual existing home sales since the early 1990s at 3.8mn.

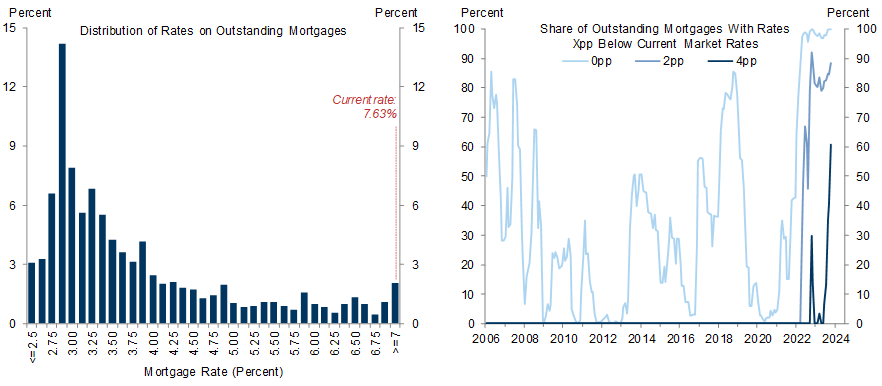

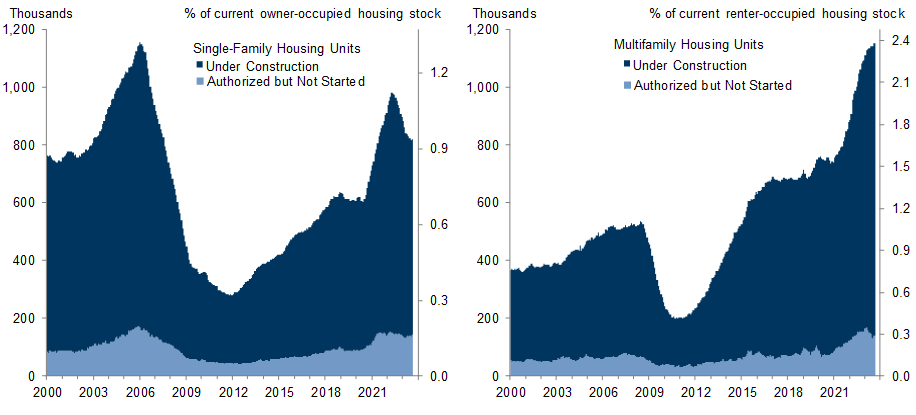

Limited available housing supply has kept homebuilding resilient to higher interest rates: despite 3½pp higher mortgage rates today, housing starts were 5% above 2019 levels in September. While vacancy rates remain at historic lows, we expect housing starts to decline by 4% to 1.34mn in 2024, reflecting sharply fewer multifamily starts. The backlog of multifamily units already under construction has grown 56% since 2020, and the pipeline for new projects has already begun to narrow.

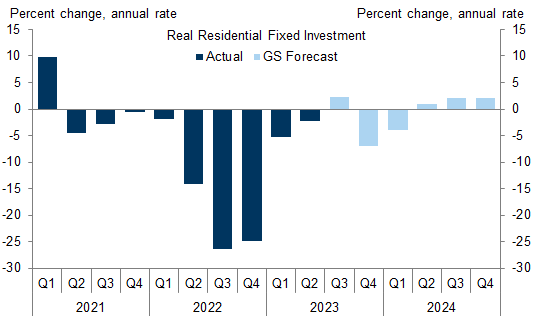

The almost 1pp rise in mortgage rates since the summer has already pushed monthly housing activity lower, and we expect those slides to continue into early next year. We expect quarterly annualized residential fixed investment growth to swing from +2% in 2023Q3 to -7% in 2023Q4 and -4% in 2024Q1, before rebounding later in 2024 for roughly flat annual growth (Q4/Q4 basis, vs. -3% in 2023).

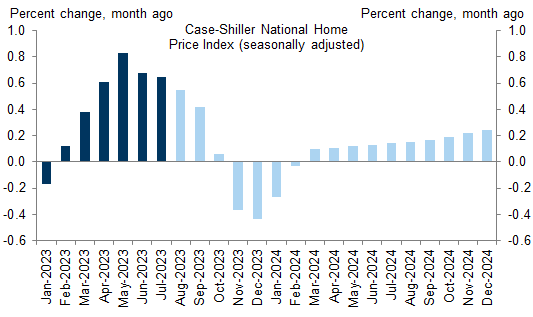

We estimate that home prices have increased 4.2% so far this year but are likely to fall 0.8% through December for a +3.4% year-over-year increase (Case-Shiller measure). We expect only modest home price growth of +1.3% in 2024, as supply remains tight but high rates weigh on affordability.

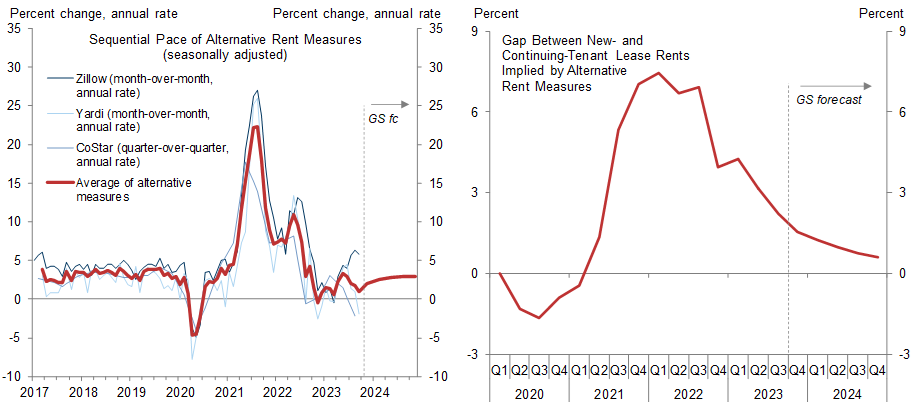

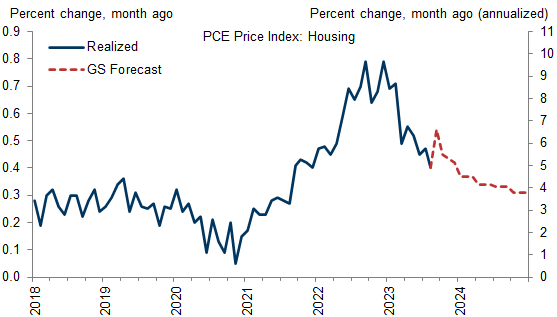

Continued oncoming multifamily supply should allow rent inflation to normalize further even as starts slow, and we expect the PCE measure to return to just above pre-pandemic levels by late 2024. PCE shelter inflation has already slowed from a peak monthly rate of +0.79% to +0.54% in the September PCE report (GS forecast), and we expect it to slow to +0.42% by December 2023 and +0.31% by December 2024, implying a decline in the year-on-year rate to 4.1%.

Higher for Longer and the 2024 Housing Outlook

Sustained Higher Rates Will Weigh on Housing Turnover

Dueling Forces for Homebuilding: Lack of Supply and Strong Income Growth vs. Construction Backlogs and Poor Affordability

Sharply Lower Residential Fixed Investment Growth in 2023Q4 and 2024Q1; Roughly Flat Growth on Net Next Year

Home Prices Likely to Decline This Winter Before Rebounding Only Modestly in 2024

Shelter Inflation Will Slow to Just Above Pre-Pandemic Levels by Late 2024

Ronnie Walker

- 1 ^ The right panel of Exhibit 3 shows that it has been historically unusual for a large share of outstanding mortgages to be more moderately below current market rates, a byproduct of the long-term decline in interest rates. A recent academic study highlighted that the large share of households with mortgage rates well below market rates could dampen the stimulative effect of future rate cuts. See David Berger et al., “Mortgage prepayment and path-dependent effects of monetary policy,” 2021.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.