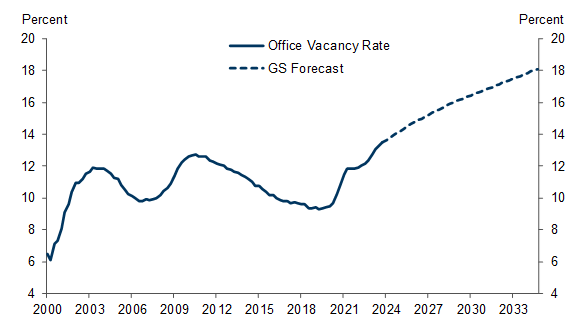

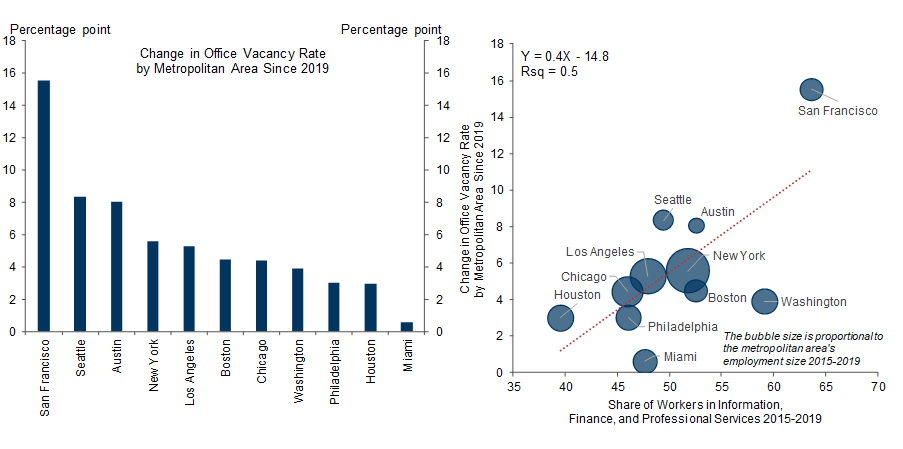

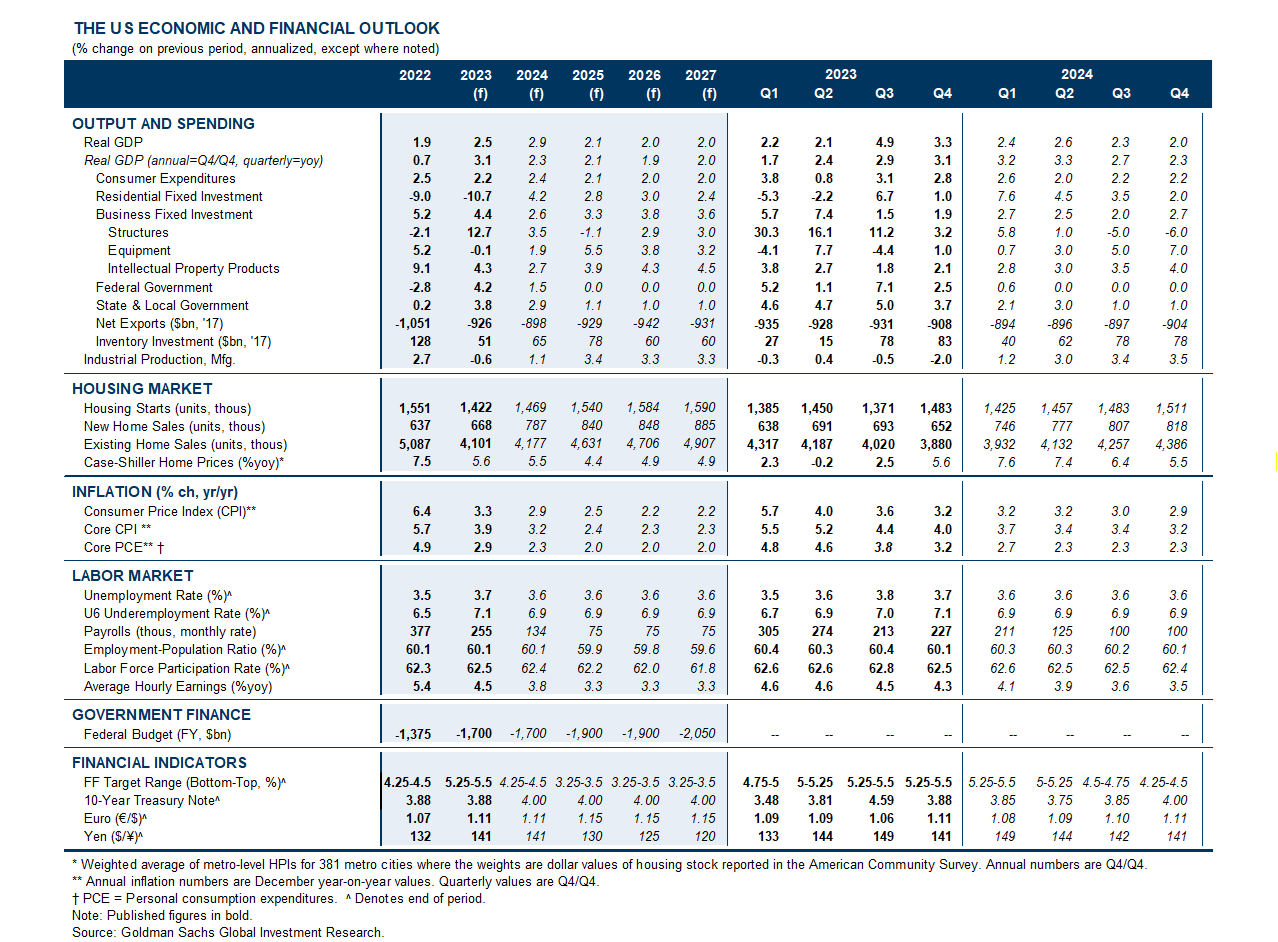

The wide adoption of hybrid work caused a structural decline in office demand. The office vacancy rate increased by 4pp over the last three years to 13.5%, the highest level since 2000. We expect the vacancy rate to rise even further in the next 10 years to 18%, as more firms reduce their demand for office space when their current leases expire. As a result, many existing buildings, especially those that are old and low-quality, may become economically nonviable as offices, raising the question of what can be done with the underutilized space.

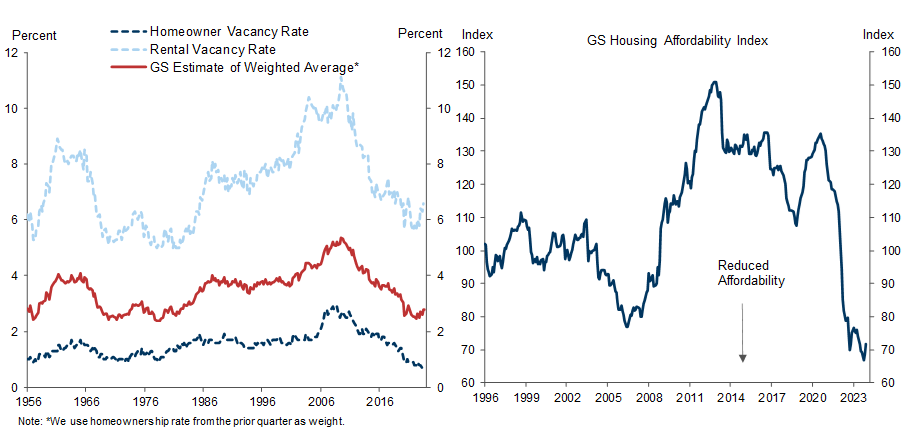

At the same time, the U.S. faces a shortage of residential housing. The imbalance between these two markets has led many investors and policymakers to wonder whether underutilized office space can be repurposed to meet the demand for residential housing. In this week’s Analyst, we provide an overview of the office market and assess the feasibility of office-to-multifamily conversion and its economic implications.

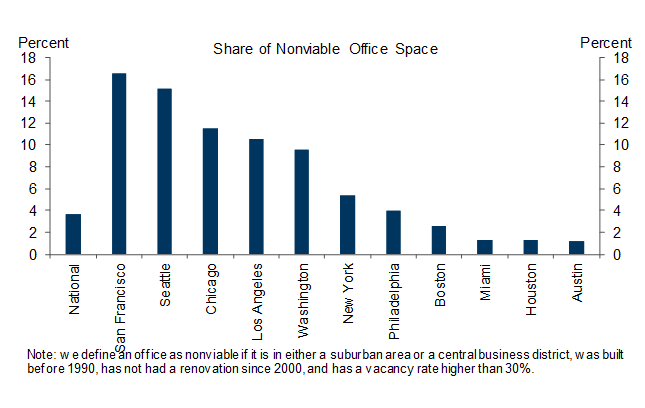

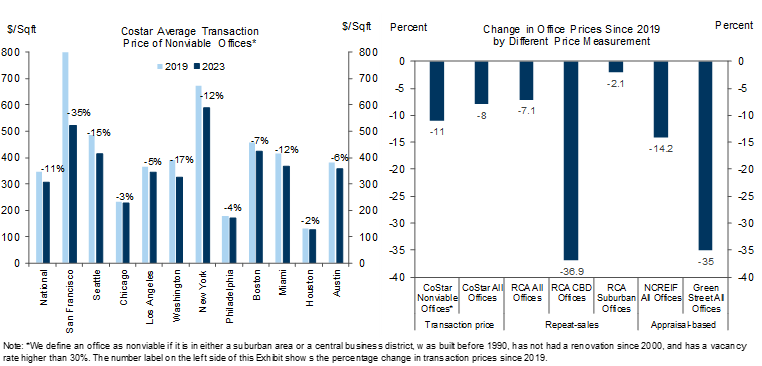

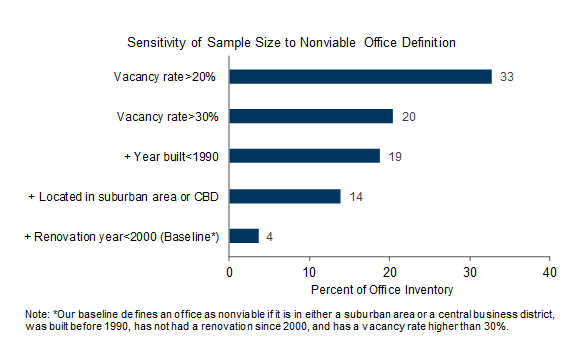

Using CoStar’s detailed dataset on commercial properties, we estimate that around 4% of US office buildings—those located in suburban areas or central business districts, built 30 or more years ago, not renovated since 2000, and currently facing vacancy rates above 30%—might be no longer viable as offices. The average transaction price of these offices has declined by 11% since 2019. In the hardest-hit cities, as many as 14-16% of offices may no longer be viable by our definition, and their average transaction prices have already fallen by 15-35% since 2019.

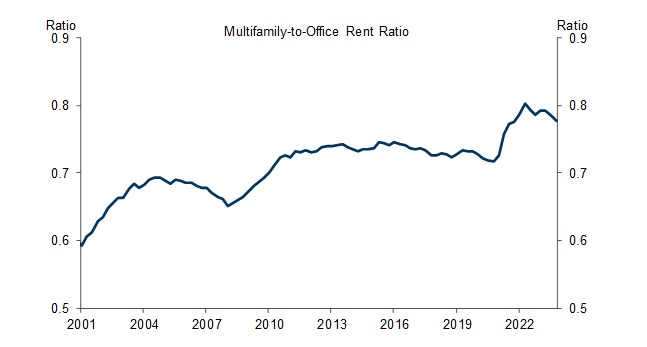

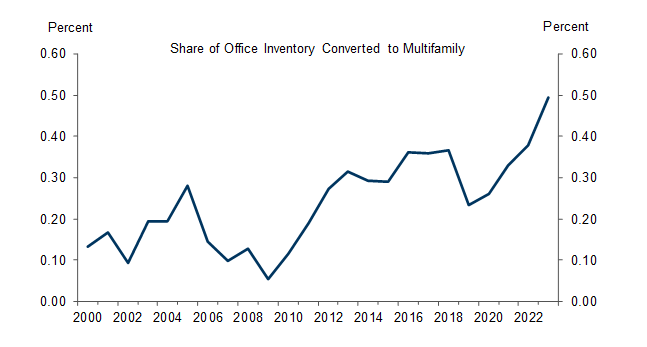

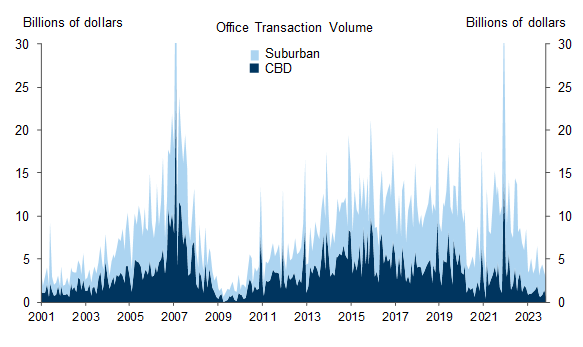

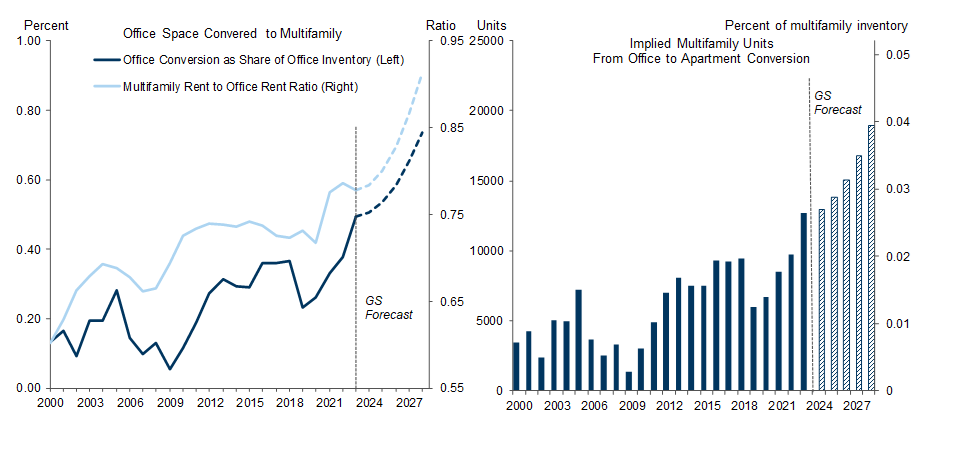

Only about 0.4% of office space was converted into multifamily units per year before the pandemic, and so far this has risen only to 0.5% in 2023, suggesting that there are still large financial and physical hurdles to conversion.

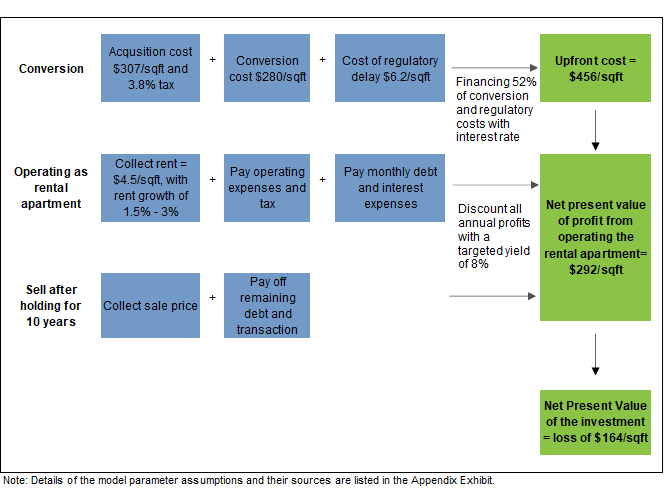

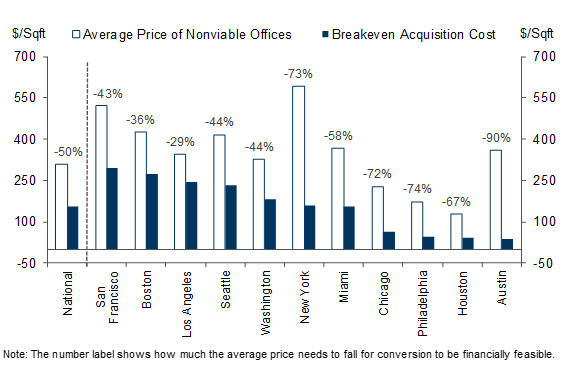

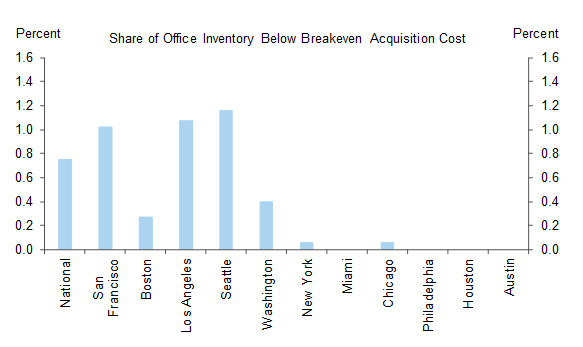

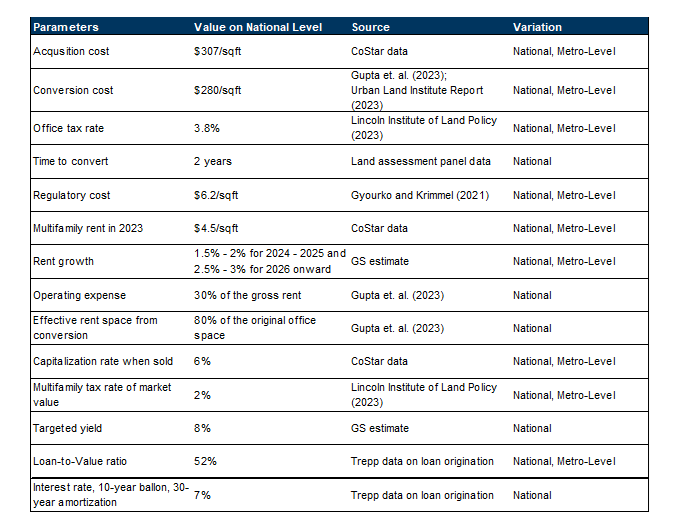

Using a discounted cash flow model, we show that current acquisition costs for struggling offices are still too high for conversion to a multifamily building to be financially feasible once we account for the high additional costs of conversion and financing. For the top 5 metropolitan areas that are most affected by remote work, we estimate that office acquisition prices would need to fall almost 50% for conversion to be financially feasible. This suggests that most of these offices will likely remain underutilized in the near term.

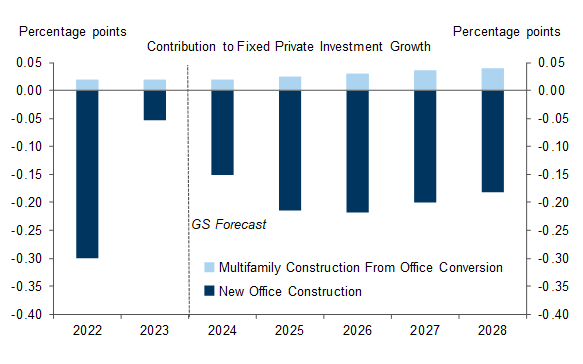

We estimate that the annual conversion rate from office to multifamily will remain low and only increase slowly to 0.7% in the next four years, delivering about 20 thousand additional multifamily units per year. Because the conversion process is slow and costly, available office space is likely to remain excessive and many buildings are likely to remain underutilized. As a result, we expect new office investment to remain sluggish in the next few years, resulting in a 0.2pp drag on fixed private investment growth, which will only be offset modestly by a 0.05pp boost from increasing multifamily construction.

The Price Is Still Too High for Office-to-Multifamily Conversion

Exhibit 6: The Average Transaction Price of These Nonviable Offices Has Declined Since 2019 But Not by Much Due to Lack of Liquidity; Alternative Valuation Methods Suggest That Actual Office Values May be Lower

Exhibit 13: We Expect Office Investment to Continue to Decline in the Next Few Years, Resulting in a Small Multi-Year Drag on Fixed Private Investment Growth, Which Will Be Offset Modestly by Increases in Residential Investment From Office-to-Multifamily Conversion

Elsie Peng

Vinay Viswanathan

Appendix

- 1 ^ We forecast the remote-work-induced rise in the office vacancy rate using the share of office leases that will become expire in the coming years and an estimate of the probability that a tenant will renew. Please see details of our forecast in our previous publication on remote work.

- 2 ^ See these reports for the age reference (here and here) and the occupancy reference (here and here).

- 3 ^ We check the sensitivity of our nonviable office sample by adding these selection criteria one by one. The Appendix Exhibit shows the result. We find that the sample size tends to shrink more after increasing the minimum vacancy rate restriction from 20% to 30% and also after adding the renovation year restriction.

- 4 ^ According to CoStar commercial listing data, the average rent of multifamily buildings that are in CBD or suburban area and were built after 2018 is currently $3/sqft. We assume the converted multifamily building will target a market segment for higher-income households. Using the Consumer Expenditure Survey, we estimate that households in the top income quintile typically spend 1.2-2 times more on housing than households in the median quintile, so we adjust the rent in our model to $4.5/sqft to reflect this.

- 5 ^ We estimate that the internal rate of return is around 3% at the current acquisition price of $307/sqft. This means that investors need to be much more patient about future returns in order to break even with today’s high costs of acquisition, conversion, and financing.

- 6 ^ Construction costs vary by different types of apartments. A report by the Brookings Institute finds that the average cost of construction ranges from $200 to $400+ per sqft depending on building heights and materials. Prices of empty land lots vary substantially across locations. Data from the American Enterprise Institute suggest that the average land value was around $30/sqft at the national level in 2022. The average land value is $84/sqft in New York metro area, $225/sqft in San Francisco metro area, and $41/sqft in Miami metro area. Land prices in central business locations can be 5 to 20 times higher than these metro-level average values.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.