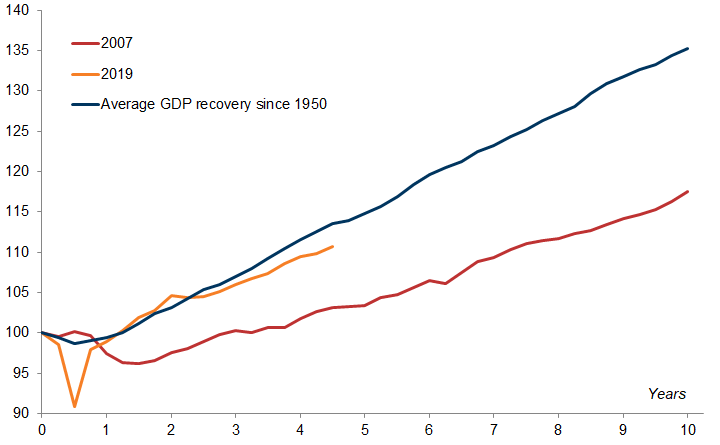

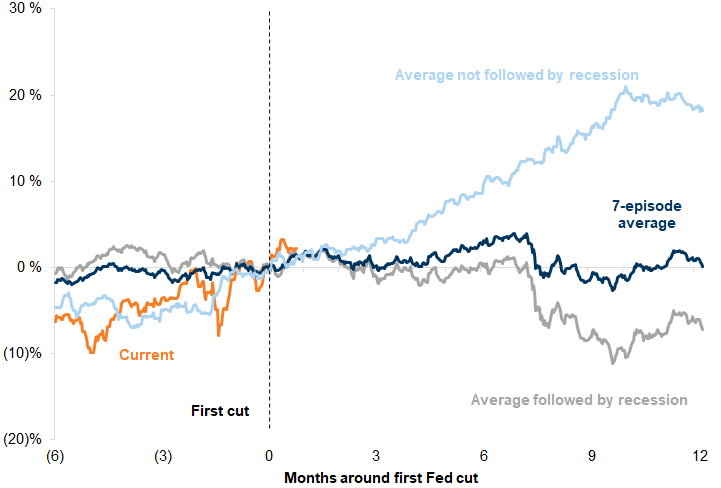

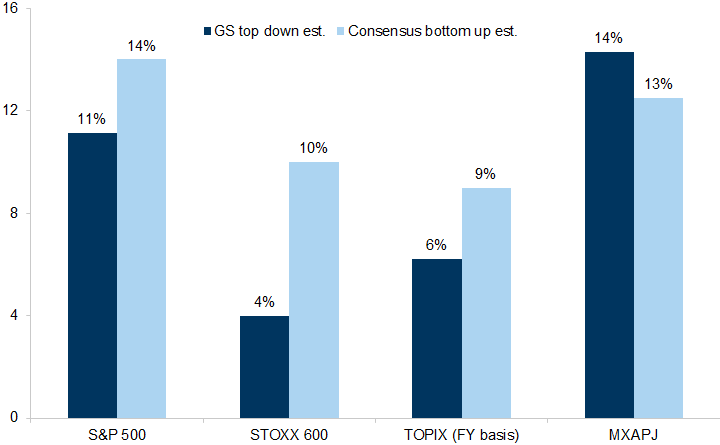

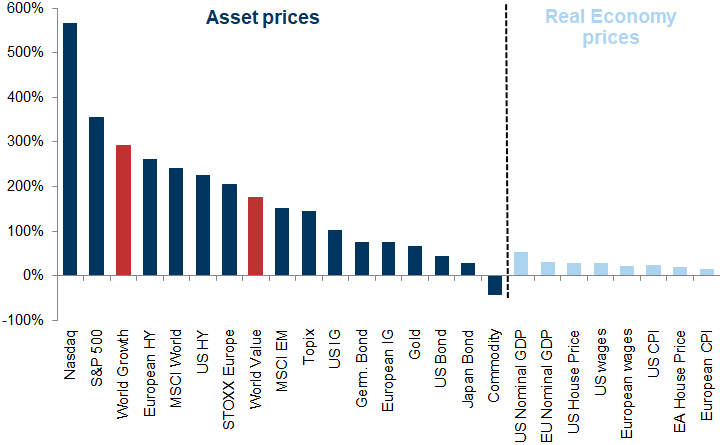

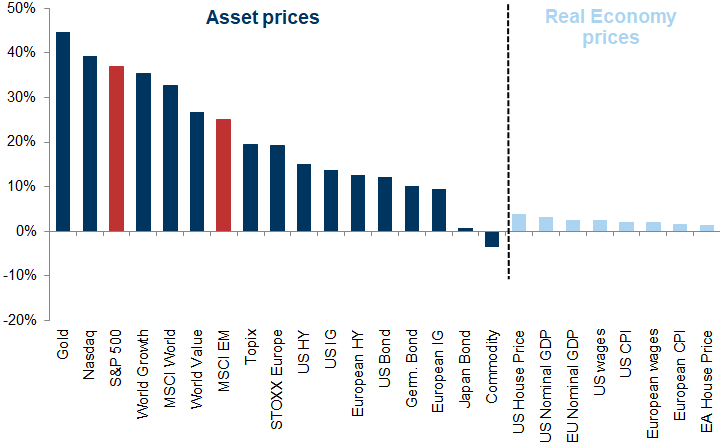

We are entering a more benign part of the cycle with a continuation of economic growth alongside lower policy rates – a combination that has historically been positive for equities.

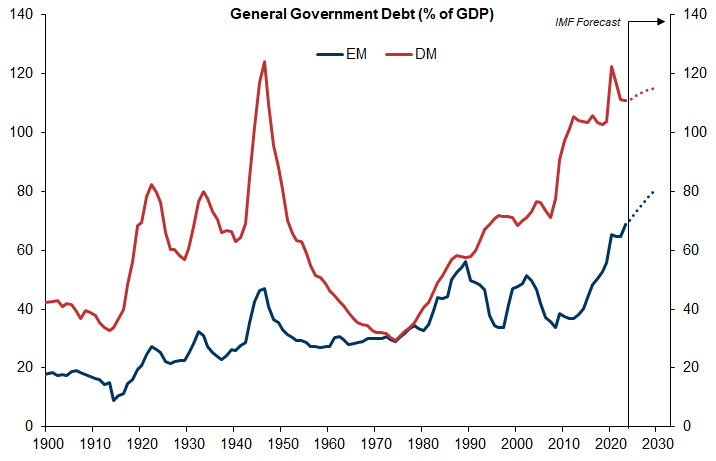

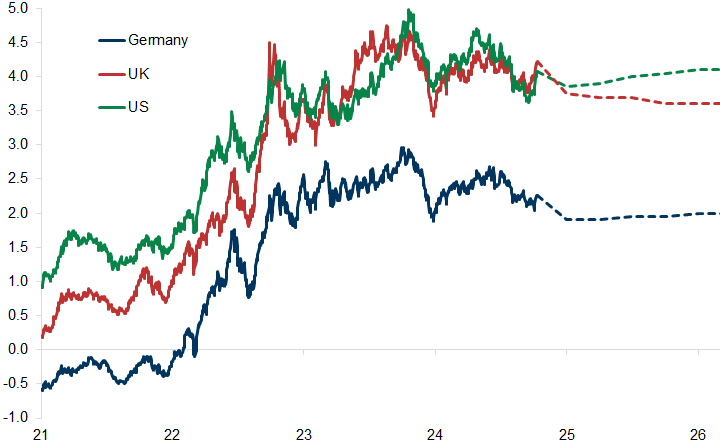

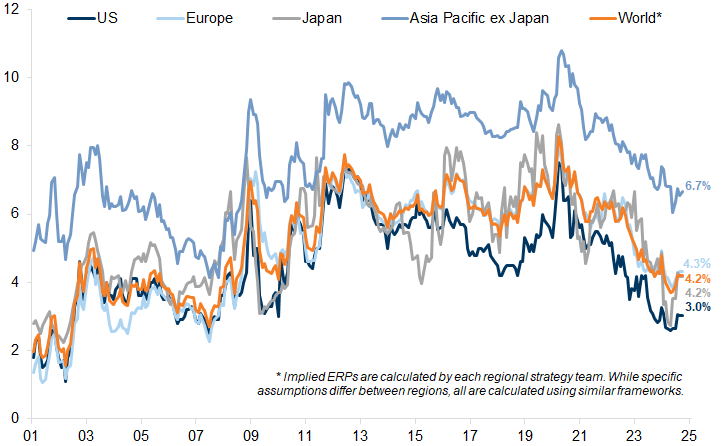

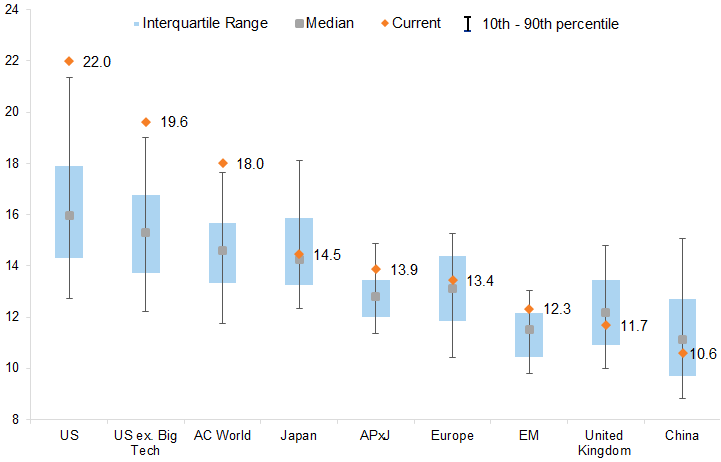

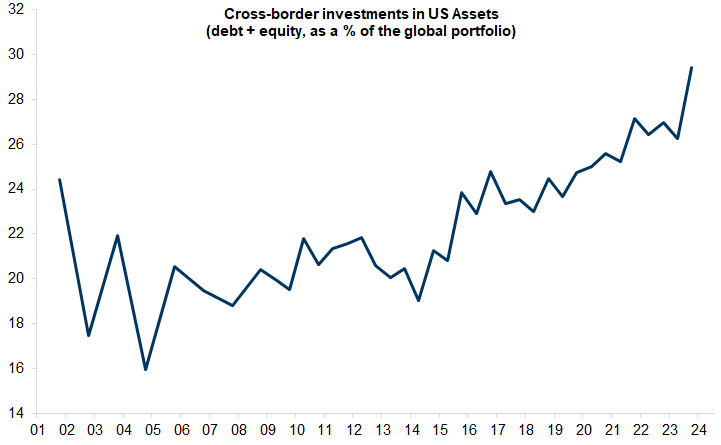

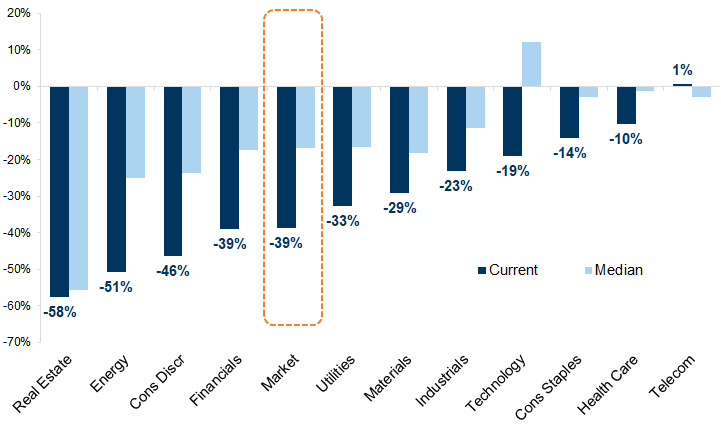

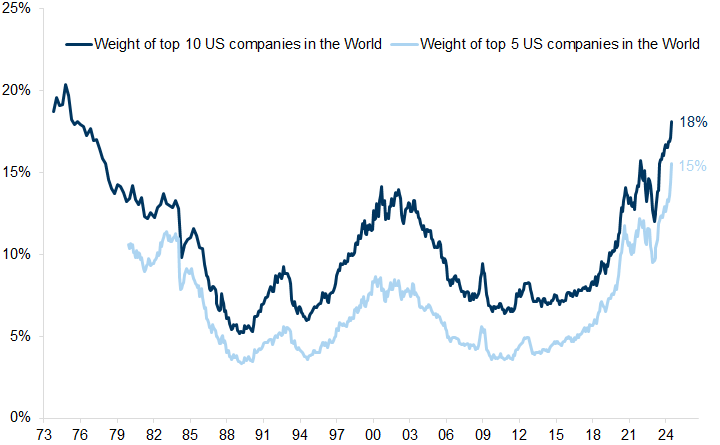

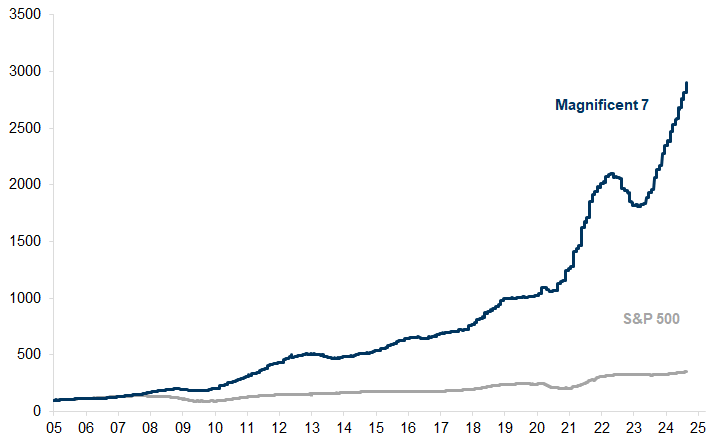

Longer-term rates are unlikely to fall given a rebuild of term premia and higher government deficits. This, together with high US equity valuations, moderates the upside in equities at the index level.

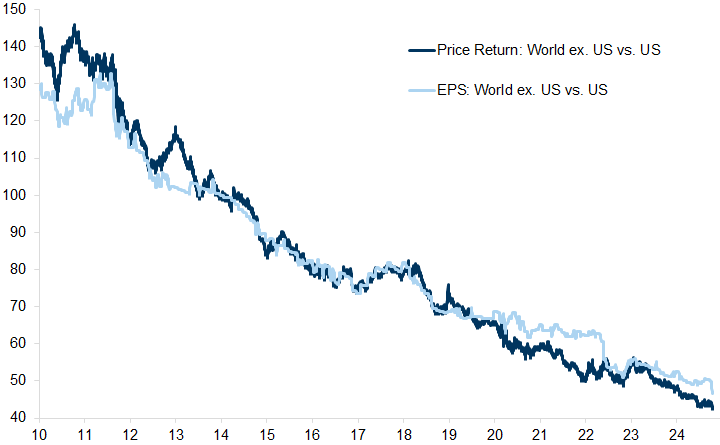

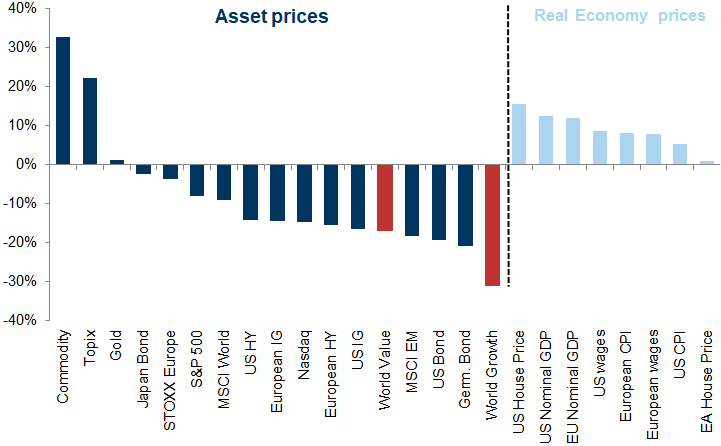

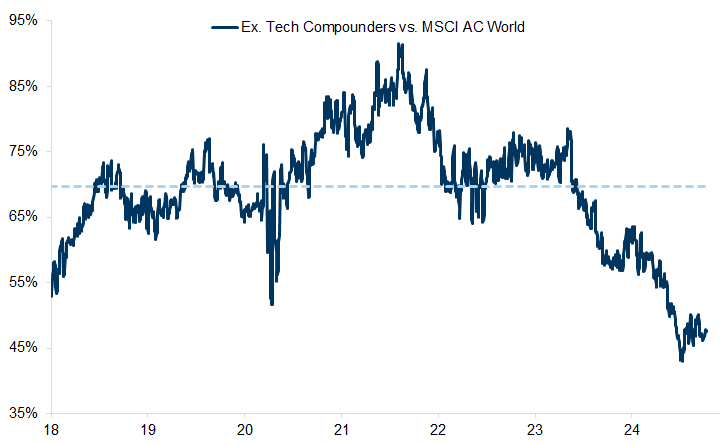

This means that alpha should become a more important driver of returns with a broadening opportunity set within and across equity markets.

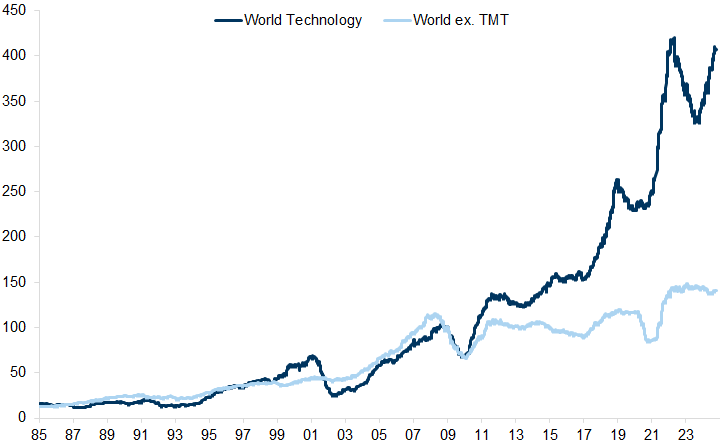

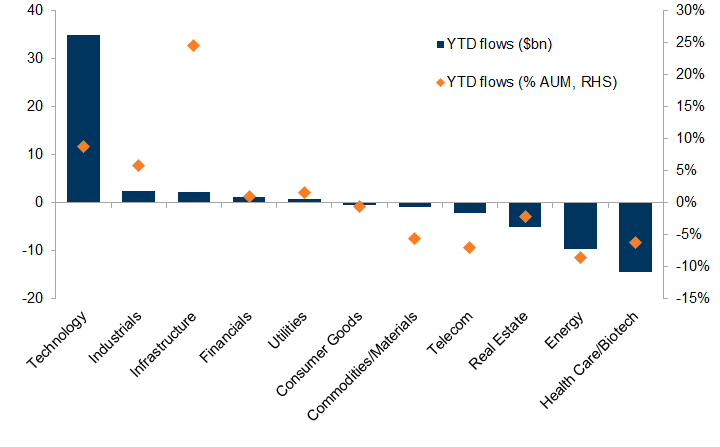

There is a growing symbiotic relationship between the potential for the Technology sector and growth in some parts of the ‘old economy’ as the needs for capex rollout and electrification increase.

The prospects for equity returns are no longer a function of whether the sector is classified as Growth or Value; it can be a bit of both.

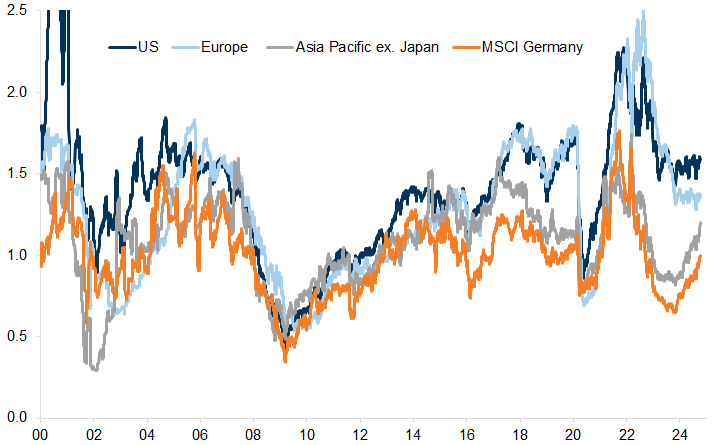

We look for opportunities to improve risk-adjusted returns through more regional diversification. We expect broadening market participation with Mid caps in the US, ETCs (ex Tech compounders) and selective Value compounders.

Where are we headed?

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.